Advertisement

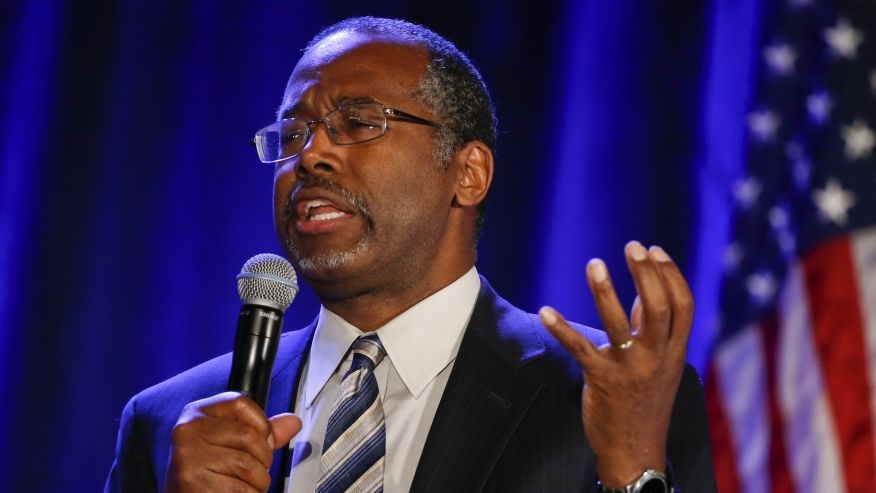

HUD’s Carson Touts Affordable Housing Strategies in MBA Speech

The Trump Administration is approaching the question of affordable housing by seeking increased private investment and expanding programs that have been successful, according to Housing & Urban Development (HUD) Secretary Ben Carson.

Speaking before the Mortgage Bankers Association’s (MBA) National Advocacy Conference in Washington, D.C., Carson highlighted an ongoing economy with “historic highs in employment, job creation, and economic growth.”

However, Carson also called on his background as a neurosurgeon to offer a diagnosis on the state of housing within the current economy.

However, Carson also called on his background as a neurosurgeon to offer a diagnosis on the state of housing within the current economy.

“But every doctor knows that a patient can look like a paragon of health, while latent and localized conditions go untreated underneath,” he said. “If any part of the body is allowed to languish, every part of the body will eventually feel its pain. Our vital organs are all in it together. So too it is with America. We are only the Land of Opportunity when opportunity is available to all. And HUD is tasked with a special mission to carry our nation’s new gains to the local doorsteps of vulnerable communities who need help most.”

Carson cited the Trump Administration’s Opportunity Zones as “one program expected to greatly increase access to capital while expanding affordable housing,” adding they “represent massive action to encourage financial capital to be invested in distressed communities.” He noted the Department of the Treasury estimated the Opportunity Zones will attract more than $100 billion dollars in private investment, and he cited his role as chairman of the newly-established White House Opportunity and Revitalization Council to ensure multiple federal agencies working together will prioritize the goals of this endeavor.

“By utilizing a single body to achieve interagency consensus–rather than having 13 separate departmental processes–the Revitalization Council can achieve faster resolution, and that means we can deliver much faster solutions,” Carson said.

Carson also pointed out his department’s expansion of the Low-Income Housing Tax Credit (LIHTC) program for multifamily home development as another strategy to expand affordable housing.

“Because new construction and substantial rehabilitation currently make up more than 40 percent of our total volume, we expect the expansion of our LIHTC Pilot to significantly increase HUD’s affordable housing volume,” he added. “More homes also create more home mortgages, which can contribute to the health of the market.”

Carson then called attention to the public-private partnership Rental Assistance Demonstration, which he said created nearly $6 billion dollars in construction investment and more than 100,000 jobs. He also held up the nearly $28 billion dollars allocated over the past year by HUD’s Community Development Block Grant-Disaster Recovery Program as “the largest single amount of disaster recovery assistance in HUD's history.”

Carson reiterated several recent White House goals to end the federal conservatorships of Fannie Mae and Freddie Mac while “facilitating competition in the housing finance market,” as well as the need to address “the financial viability of the Home Equity Conversion Mortgage program” and reduce “abusive and unsound loan origination or servicing practices for loans” within the Ginnie Mae program.

“Solving affordable housing challenges requires a team effort,” Carson said. “It’s been said that, ‘the bigger the dream, the more important the team’–and few ambitions are more compelling, or necessary, than that of the American Dream.”

About the author