Advertisement

Pending Homes Sales Up, Mortgage Rates Down

The National Association of Realtors (NAR) reported that its Pending Home Sales Index (PHSI) was up reached 105.4 in May, up 1.1 percent from 104.3 in April. Compared to last year, contract signings dropped by 0.7 percent–May is the 17th straight month of annual decreases.

On a regional measurement, the PHSI in the Northeast rose 3.5 percent to 92, the Midwest index grew 3.6 percent to 100.3 and the South saw a slight 0.1 uptick to an index of 124.1. Only the West saw a decline, falling 1.8 percent to 91.8.

Lawrence Yun, NAR’s chief economist, attributed the rise in pending sale to falling mortgage rates.

Lawrence Yun, NAR’s chief economist, attributed the rise in pending sale to falling mortgage rates.

“Rates of four percent and, in some cases even lower, create extremely attractive conditions for consumers,” he said. “Buyers, for good reason, are anxious to purchase and lock in at these rates.”

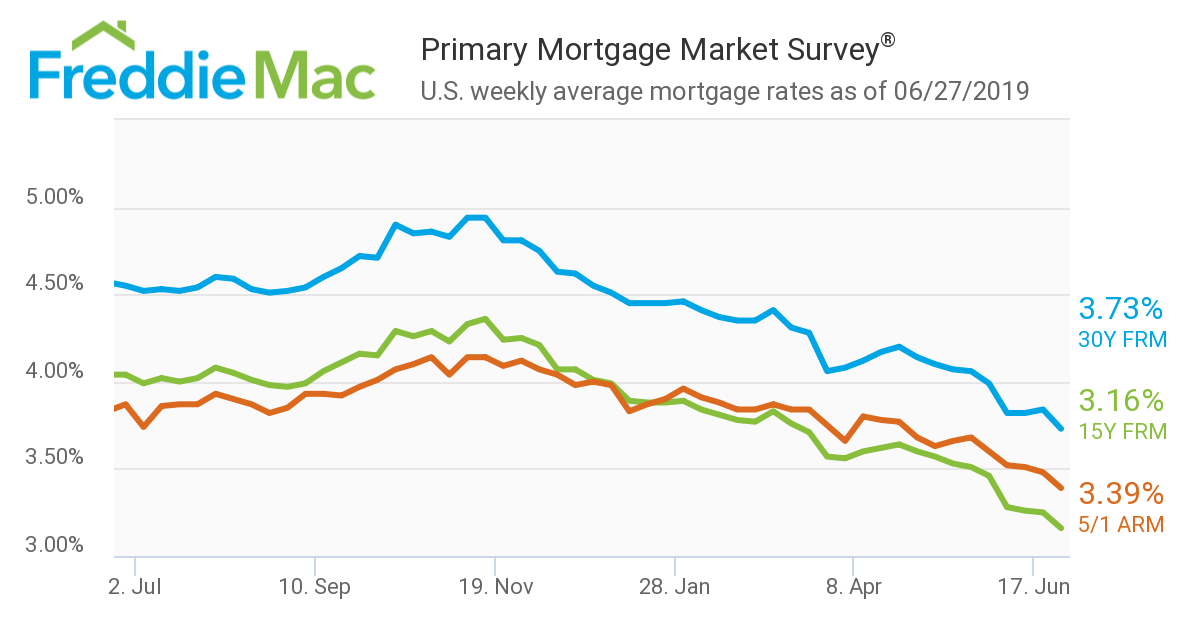

As for the latest mortgage rate data, Freddie Mac reported the 30-year fixed-rate mortgage (FRM) averaged 3.73 percent for the week ending June 27, 2019, down from last week when it averaged 3.84 percent. This marked the seventh time in the last nine weeks that the 30-year FRM declined, as well as its lowest level since November 2016. The 15-year FRM averaged 3.16 percent, down from last week when it averaged 3.25 percent, and the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.39 percent, down from last week when it averaged 3.48 percent.

“While the industrial and trade related economic data continues to dominate the news, the drop in mortgage rates over the last two months is already being felt in the housing market,” said Sam Khater, Freddie Mac’s chief economist. “Through late June, home purchase applications improved by five percentage points compared to the previous month. In the near-term, we expect the housing market to continue to improve from both a sales and price perspective.”

About the author