Advertisement

Study Affirms Racial Disparity in Housing During Economic Expansion

The gaps homeownership, home equity and wealth between Whites and Blacks widened during the economic expansion years that followed the Great Recession, according to a new data study from Redfin.

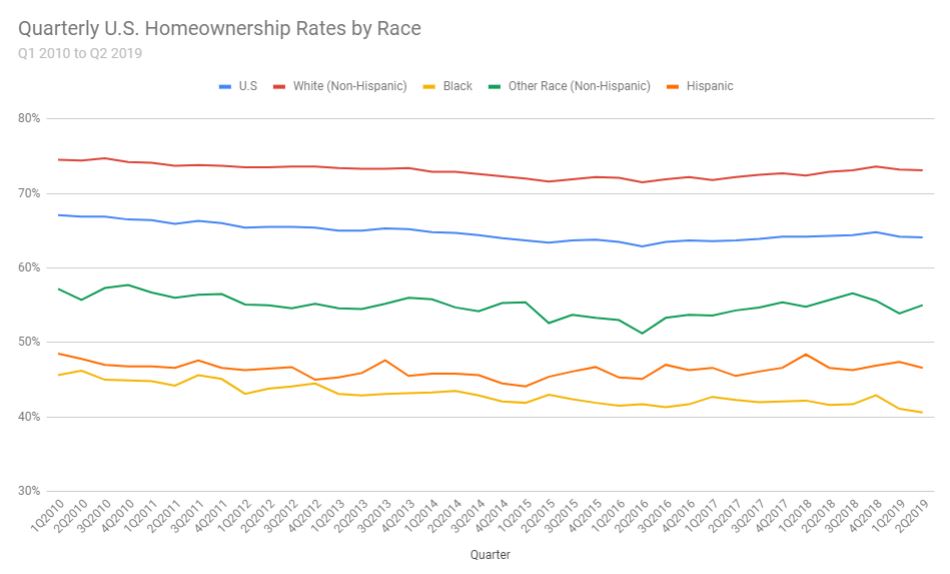

Homeowners in predominantly White neighborhoods saw an average gain of $70,000 more in home equity than homeowners in primarily Black neighborhoods from 2012 to 2018. As of the second quarter of this year, 73.1 percent of White Americans owned homes, compared to 40.6 percent for African-Americans and 46.6 percent for Hispanics–in comparison, the rates in the first quarter of 2010 were 74.5 percent for whites, 45.6 percent for Blacks and 48.5 percent for Hispanics. The 32.5 percentage-point gap in homeownership between Whites and Blacks in the second quarter is 3.6 points wider than it was at the beginning of 2010 and half a point wider between Whites and Hispanics.

Homeowners in predominantly Black neighborhoods smaller dollar gains in home equity ($120,800) from 2012 to 2018 compared to the gains in predominantly White neighborhoods ($190,935) and primarily Hispanic communities ($206,000) during the same period. Home prices in majority-Black neighborhoods rose 24.9 percent from 2012 to 2018, higher than the 21 percent gain for mostly Hispanic communities and the 12.5 percent gain for mostly White communities. But while homeowners in majority-Black neighborhoods saw the biggest percentage gain in equity (213 percent), Redfin noted these properties started with substantially lower equity than the residences in White or Hispanic neighborhoods.

"With higher unemployment rates and less wealth to begin with, Black Americans were less able to buy homes even when prices were at their lowest point, meaning many missed out on opportunities to build wealth and put down roots in their communities through homeownership," said Redfin Chief Economist Daryl Fairweather. "The growing racial homeownership gap has widened the wealth gap, as home equity remains one of the most significant wealth-building tools. And now, with higher home prices and tighter lending standards than before the housing crash of 2008, it's more difficult than ever for minorities to break into the housing market. That's likely to contribute to growing economic inequality in the U.S."

As means to combat the gap in minority homeownership, the Mortgage Bankers Association (MBA) and Fannie Mae’s Future Housing Leaders program recently launched a partnership designed to promote diversity and inclusivity in housing finance, via MBA Education’s programs and various networking events. In early July, presidential hopeful Sen. Kamala Harris (D-CA) introduced a proposal for a new $100 billion federal program that she claims will close "the racial wealth gap” in regards homeownership.

About the author