Advertisement

HUD Expands Section 220 Program to All Opportunity Zones

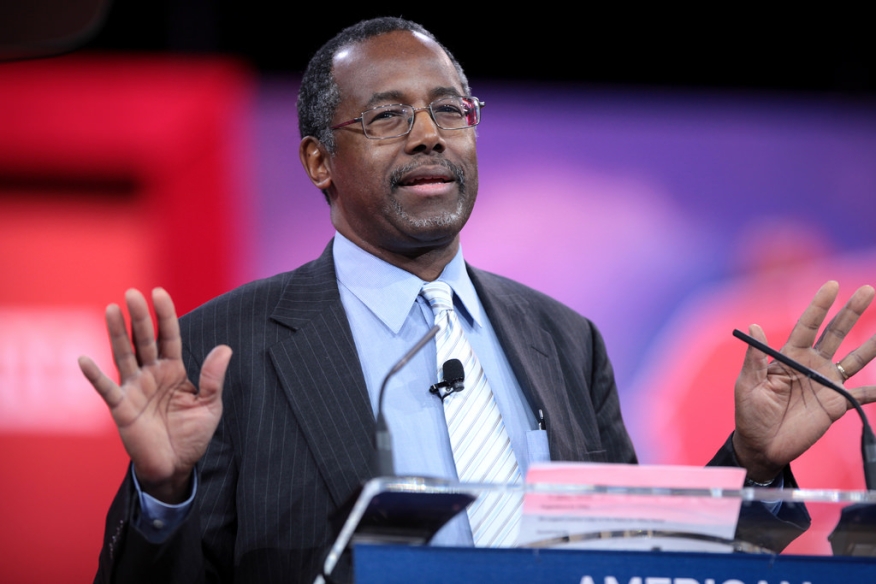

Housing and Urban Development (HUD) Secretary Ben Carson has announced the Federal Housing Administration (FHA) will insure mortgages on mixed-use developments under the agency’s Section 220 Program in the lower income communities participating in the Opportunity Zones program.

FHA’s Section 220 Program insures lenders against loss on mortgage default and has been used for urban rental housing in areas targeted for overall revitalization. Carson’s announcement expands eligibility of mortgages insured under this program to all 8,764 Opportunity Zone localities, including those in rural areas.

“By expanding this program’s reach, we hope to significantly boost private investment in Opportunity Zones and generate growth in development in neighborhoods that need it most,” said Carson. “With expanded mixed-used development in Opportunity Zones comes economic revitalization and job growth which is just what the doctor ordered for residents living in these communities.”

About the author