Advertisement

Existing-Homes Sales Up 2.5 Percent

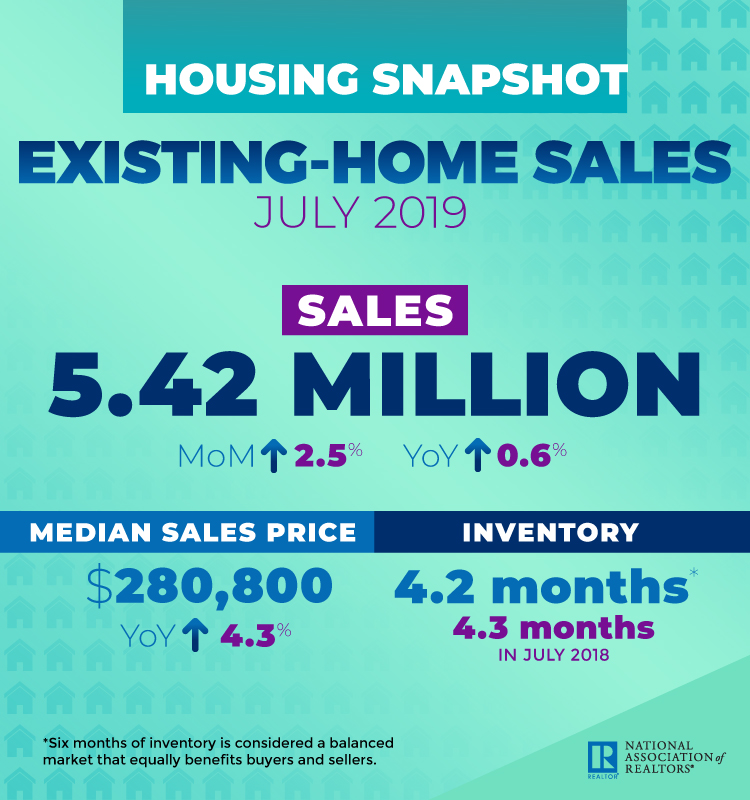

Total existing-home sales during July totaled a seasonally adjusted rate of 5.42 million, up 2.5 percent from the previous month and up 0.6 percent from one year earlier, according to new data from the National Association of Realtors (NAR).

The median existing-home price for all housing types in July was $280,800, up 4.3 percent from the $269,300 price set one year earlier. July’s price increase marked the 89th straight month of year-over-year gains.

While sales and prices were up, the total housing inventory fell last month to 1.89 million, down from the 1.92 million level set in the previous month and the previous year. The unsold inventory level was at a 4.2-month supply and properties typically remained on the market for 29 days.

Also last month, first-time buyers were responsible for 32 percent of sales, down from 35 percent in June but matching the same level in July 2018. Individual investors or second-homebuyers were responsible for 11 percent of home sales last month, while all-cash sales were at the core of 19 percent of transactions. Distressed sales represented only two percent of sales, with less than one percent pegged to short sales.

“Falling mortgage rates are improving housing affordability and nudging buyers into the market,” said Lawrence Yun, NAR’s chief economist. “The shortage of lower-priced homes have markedly pushed up home prices.”

About the author