Advertisement

Home Price Growth in Car-Dependent Neighborhood Outpaces Walkable Areas

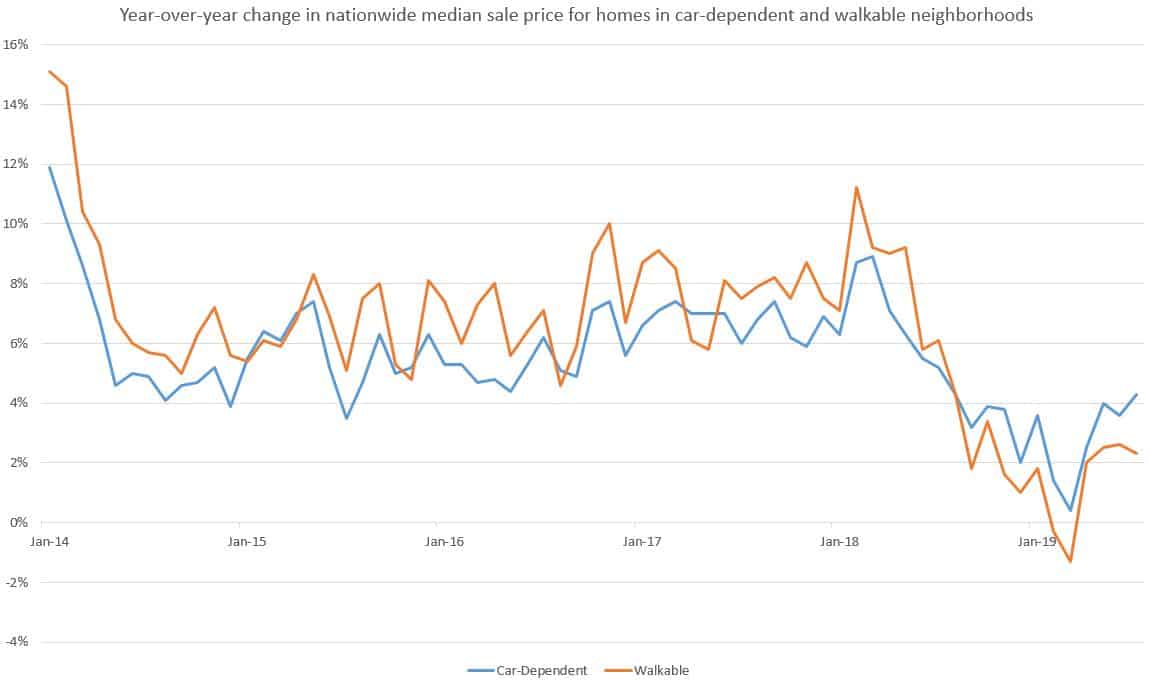

Home sale prices in neighborhoods where residents are car-dependent increased at a greater rate than the prices on property in neighborhoods that are considered walkable, according to new data from Redfin.

During July, home-sale prices in walkable neighborhoods across the country increased 2.3 percent year-over-year to a median $343,900. However, home prices in car-dependent areas shot up by 4.3 percent annually to a median of $312,100. Sales were down in both types of neighborhood during July, although walkable areas saw a 7.1 percent annual drop nationwide compared to the 3.3 percent decline in home sales in car-dependent neighborhoods.

The greatest decline in sales prices among walkable neighborhoods in July were San Jose (-7.2 percent) and Seattle (-6.5 percent), while the car-dependent Philadelphia metro saw the greatest sales price spike with a 17.9 percent annual increase.

"In the second half of 2018, homes in the hottest coastal markets became so expensive that most homebuyers became priced out of walkable neighborhoods, where homes tend to sell at a premium," said Redfin Chief Economist Daryl Fairweather. "It's not that people value walkability any less than they used to. Many homebuyers are simply relegated by their budgets to live in car-dependent areas, which have since seen demand and home prices grow at a faster rate. The trend also has implications for society, with families becoming further segregated by class and race, as well as for the environment, as more demand in car-dependent areas means more carbon emissions. Growing cities can combat these issues by adopting policies that encourage building more dense, affordable housing in walkable areas."

About the author