Advertisement

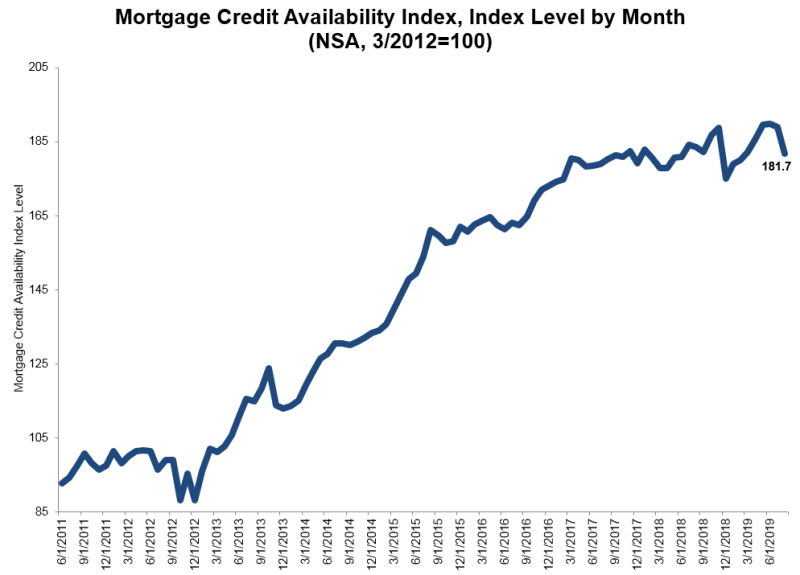

Mortgage Credit Availability Declines

The level of mortgage credit availability was on the decline last month, according to new data from the Mortgage Bankers Association (MBA).

The trade group’s Mortgage Credit Availability Index (MCAI) dropped by 3.9 percent to 181.7 in August. The Conventional MCAI decreased 3.6 percent, and its component indices also fell: the Jumbo MCAI was 3.2 percent lower and the Conforming MCAI was 4.3 percent lower. The Government MCAI took a 4.1 percent slide.

“Credit supply declined across the board in August, even as mortgage rates fell and application activity picked up, particularly for refinances,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Last month’s decrease was the largest since December 2018, and also the first tightening we have seen for conventional loans all year. We anticipate some weakening of the job market in the year ahead as economic growth cools. It’s possible some lenders may be tightening credit in expectation of a slowdown.”

About the author