Advertisement

Existing-Home Sales Drop in September

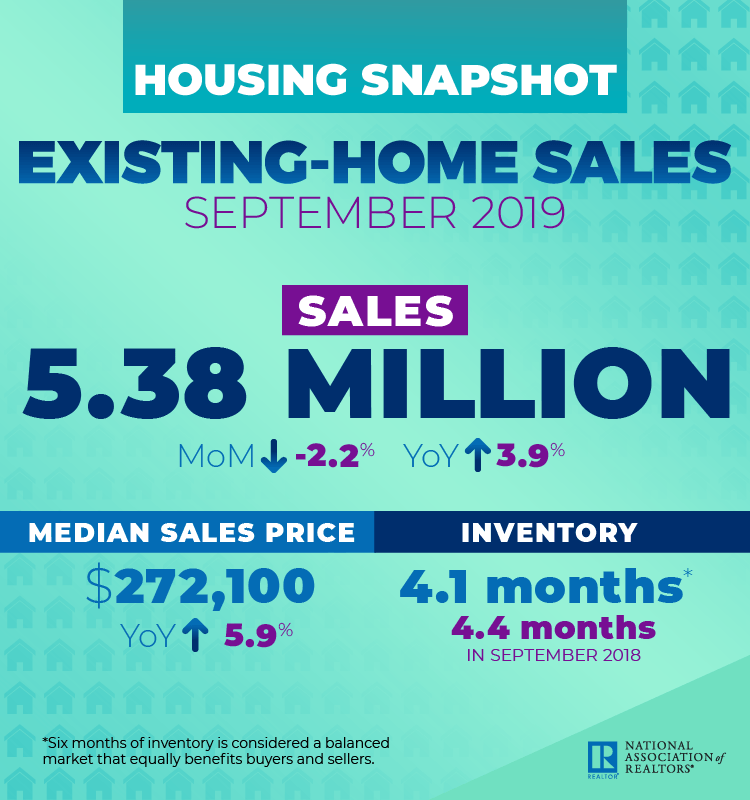

After two consecutive months of increases, existing-home sales fell in September, according to the National Association of Realtors (NAR).

Total existing-home sales were down by 2.2 percent from August to a seasonally adjusted annual rate of 5.38 million in September, although up 3.9 percent from the 5.18 million level set in September 2018. The median existing-home price for all housing types in September was $272,100, a 5.9 percent rise the $256,900 price set one year earlier. September marked the 91st straight month of year-over-year gains in median existing-home prices.

“Even though September home sales did not rise above 5.5 million units, it remained strong as the housing market continued to benefit from slower economic growth in 2019," said Tian Liu, Chief Economist at Genworth Mortgage Insurance. "Slower growth has pushed down interest rates and slowed growth in home prices, making housing more affordable.”

First-time buyers were responsible for 33 percent of sales in September, up from 31 percent in August and 32 percent in September 2018. Total housing inventory at the end of September sat at 1.83 million, mostly unchanged from August but 2.7 percent below the 1.88 million level from one year ago. Unsold inventory is at a 4.1-month supply at the current sales pace, up from 4.0 months in August and down from the 4.4-month figure recorded in September 2018, and properties typically remained on the market for 32 days in September, up from 31 days in August and even with September 2018. Nearly half of homes sold in September were on the market for less than a month.

“We must continue to beat the drum for more inventory,” said NAR Chief Economist Lawrence Yun. “Home prices are rising too rapidly because of the housing shortage, and this lack of inventory is preventing home sales growth potential.”

Mike Fratantoni, senior VP and chief economist of the Mortgage Bankers Association (MBA), said: “Existing-home sales declined in September, but are running more than seven percent ahead of last year’s sales pace, led by an almost 10 percent gain in the South. Home sales still remain constrained by a lack of inventory, with only 4.1 months of supply at the end of last month. The combination of a strong job market and low mortgage rates continue to support housing demand as 2019 comes to a close. Buyer interest is particularly robust among first-time homebuyers, who made up a third of sales last month. Millennials’ interest in homeownership is strong, and should continue to support home sales growth heading into next year, given the low rate environment and still favorable economic conditions.”

About the author