Advertisement

Serious Delinquency Rate at 14-Year Low

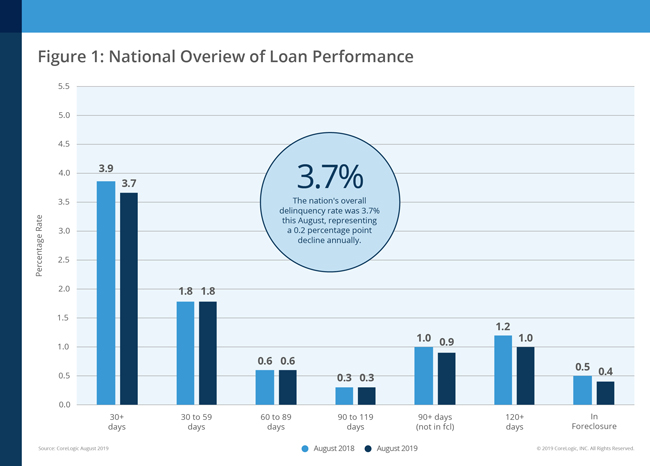

New data from CoreLogic has found 3.7 percent of all mortgages were in some stage of delinquency during August, down 0.2 percent from one year ago. As of August, the foreclosure inventory rate reached 0.4 percent, down 0.1 percentage point from the previous year, and the August foreclosure inventory rate tied the prior nine months as the lowest for any month since at least January 1999.

The rate for early-stage delinquencies was 1.8 percent in August, unchanged from one year earlier, and the share of mortgages 60 to 89 days past due was 0.6 percent, also unchanged from August 2018. The serious delinquency rate of 1.3 percent was down from 1.5 percent in August 2018 and was the lowest for the month of August since 2005 when it was also 1.3 percent. The share of mortgages that transitioned from current to 30 days past due was 0.8 percent, unchanged from August 2018.

Five states posted small annual increases in overall delinquency rates in August: Iowa (0.2 percentage points), Minnesota (0.1 percentage points), Nebraska (0.1 percentage points), Wisconsin (0.1 percentage points) and Rhode Island (0.1 percentage points). Nineteen metropolitan areas recorded small annual increases in their serious delinquency rates, with the largest increases were Panama City, Fla. (0.9 percentage points), Jacksonville, N.C. (0.2 percentage points), Wilmington, N.C. (0.2 percentage points), and Goldsboro, N.C. (0.2 percentage points).

“Delinquency rates are at 14-year lows, reflecting a decade of tight underwriting standards, the benefits of prolonged low interest rates and the improved balance sheets of many households across the country,” said Frank Martell, president and CEO of CoreLogic. “Despite this month’s near record-low serious delinquency rate, several metros in hurricane-ravaged areas of the Southeast have experienced higher delinquency rates of late. We expect to see these metros to return to pre-disaster delinquency rates over the next several months.”

About the author