Advertisement

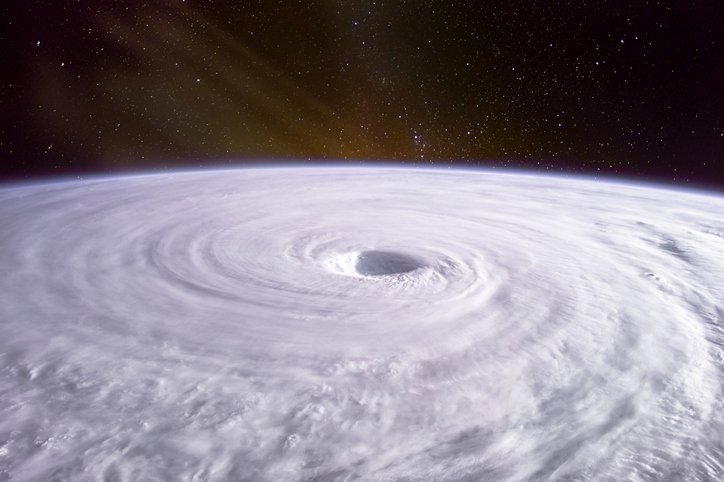

The Beckwith Blog: In the Eye of the Storm!

Here I am, sitting at a rented lake house in central New Hampshire, in my hometown from my childhood. It’s a Friday morning and I am in the rare place to have my folks and siblings be able to drop by for a visit. I am home for a birthday party weekend for yours truly, my “a-hem” (insert cough) 50th, I mean 39th Birthday. I am feeling nostalgic now so writing my Blog for this month feels a little melancholy, but with that said, I want to provide value at a time I know you will be reading this over the holidays. This time of year breeds a long-awaited pause or slowing for everyone in our field, a welcomed one for a year that gifted us with lower rates and lots of volume for those who dialed in and worked hard.

Over the prior six months, I have traveled across the nation, truly, to incredible conventions, to speaking gigs and events, too many to mention, and along the way, I found myself amid others doing the same. Professionals who, by and large, were trying to grab market share, sling their product and of course, connect with new opportunities. That said, in the midst of this storm, I began to watch and absorb the true magnitude of the chaos and rapid-fire environment that would represent the greatest year and closest thing to a return to our prior great market years that had been experienced in over a decade.

So, what did I learn? Living in the “Eye of the Storm” is quite incredible. I learned that at the core of our human spirit lives a desire for people to join forces, to come together, to laugh, to help one another and to truly support each other’s businesses. I learned that you can consistently travel for a dozen straight weeks at a time, run a business, pack and unpack, show up in stellar mode, perform and check the box until the next stop. A rock star life ensued for me this year, while trying to maintain some form of normalcy at the home front, stopping home for four days in-between to do kid’s activities, home activities, personal accounting, family time, sports and God willing, a little rest. As the weeks would wear on this year though the façade and glamour of the “mortgage industry convention circuit,” I would have some of the most incredible and tender moments that you can only recognize as powerful in hindsight.

Five lessons learned this year in the “Eye of the Storm: Work versus personal lessons”

1. Networking is still in our new age of technology, is the greatest way to form relationships that lead to long-term business: There was no greater ROI on any other marketing avenue than this for me this year. It is and has been the tried and true way to cultivate, vet and grab market share.

Personal lesson: There are the most beautiful souls out there in our business who are filled with the entrepreneurial spirit … people who I know will change the landscape of our tomorrows in this industry. I also fell in love with those “OG” mortgage professionals who are still evolving and re-defining themselves in a new era and there are many!

2. Technology is at the top of everyone lists: The mortgage industry wants to evolve into a more mobile and automated world. I heard, in many conventions, the quotes of “ancient systems” and “dinosaur ages” when describing our technical world here and how it’s truly time for evolution. People seemed to be listening. I certainly was and I am excited for once to see where this goes.

Personal lesson: Instead of cringing about the need for technology I did not welcome, I could see even my own sentiment on this topic had changed. Listening to so many rooms on this topic, I can see people are embracing this era and time. We will see evolution in this area in the years ahead finally.

3. PC is so “yesterday’s news:” No matter what surrounds the mortgage industry and all of its many minute details, at the core of our existence remains the human experience and what seemed to jump off the pages of social media this year was the “more personal stories” of homeownership successes, businesses successes and authentic story-telling from human-minded messages from the B2B entrepreneurs are now filling our space. Those companies that continue an aesthetic-minded approach to their social media might as well throw their money out the window of their moving car.

Personal lesson: I say “Thank God!” I don’t know how else to be but real, raw and authentic, I am grateful it is in style this year.

4. No more fake news: It’s now time for everyone to listen to the entrepreneurs. Our salesfolks, the loan originators, brokers and front-line men and women are where the real news lies. These folks are taking to their social media outlets, videos in hand, and are letting us know what is real or not real. It’s beautiful and it trumps (pun intended) the contrived news stories paid for by commercialized news-telling. I write for this magazine and many others that I know do diligence to their news-telling and this is not intended to be a slam to that format, I think those news companies who are employing a “story-telling” philosophy and bringing the voices of those people to their pages, podcasts and stories, it’s the smartest thing they could have done.

Personal lesson: Me and my organization are the real deal, and I run with a real deal crew. Get real … it’s the best advice I can give you.

5. Life is short, in business and for real: To live a long life in the mortgage profession, which I have somehow accomplished, staying put is not an easy task. I wrote an article in early 2018 about staying in a “Safe Seat” of musical chairs and gave advice. That advice was never more poignant than this year when the “grass is greener” philosophy and the waving of company flags were being shaken harder than ever before. Volume would be the glue that kept loan officers in their seats and many business development managers found themselves in the hot seats trying to explain slow recruiting because nobody who wasn’t suffering truly where they were was moving. For many mortgage professionals, their homes seem short-lived. The life of the mortgage originator’s job or longevity with a firm, has been truly shortened this past year and movement has been an acceptable thing that hiring firms have learned to accept on resumes that show lots of past employers. That is changing. Everyone is getting into their “Happily Ever After Seats” for the next decade and living their lives in their best way.

Personal lesson: After watching three of my family members weather terminal illnesses, I truly have accepted the shortness of our lives and careers. In the past two years, I have left a firm I worked at for 12 years and started my own company. I turned 50 as I said at the start of this article and I am realizing time is a precious commodity. So, my advice here is simply that we must live our best life and our absolute most genuine life.

Time is of the essence and I think everyone should be operating with the ideology of that every single day. There is no greater piece of advice I can offer to people. I hope you heed this advice.

In ending this short “Blog,” I offer that living in the “Eye of the Storm” this year was beautiful, meaningful, rich in relationship and experience, rewarding and quite frankly far more compelling than sitting on the sidelines. I would highly recommend that you all get out there, out of your seats and out of your comfort zones and get into the mix. There is beauty in the buzz. Be part of the buzz. I feel like this year, I became part of the buzz. I like it. Long live the storm!

2. Technology is at the top of everyone lists: The mortgage industry wants to evolve into a more mobile and automated world. I heard, in many conventions, the quotes of “ancient systems” and “dinosaur ages” when describing our technical world here and how it’s truly time for evolution. People seemed to be listening. I certainly was and I am excited for once to see where this goes.

Personal lesson: Instead of cringing about the need for technology I did not welcome, I could see even my own sentiment on this topic had changed. Listening to so many rooms on this topic, I can see people are embracing this era and time. We will see evolution in this area in the years ahead finally.

3. PC is so “yesterday’s news:” No matter what surrounds the mortgage industry and all of its many minute details, at the core of our existence remains the human experience and what seemed to jump off the pages of social media this year was the “more personal stories” of homeownership successes, businesses successes and authentic story-telling from human-minded messages from the B2B entrepreneurs are now filling our space. Those companies that continue an aesthetic-minded approach to their social media might as well throw their money out the window of their moving car.

Personal lesson: I say “Thank God!” I don’t know how else to be but real, raw and authentic, I am grateful it is in style this year.

4. No more fake news: It’s now time for everyone to listen to the entrepreneurs. Our salesfolks, the loan originators, brokers and front-line men and women are where the real news lies. These folks are taking to their social media outlets, videos in hand, and are letting us know what is real or not real. It’s beautiful and it trumps (pun intended) the contrived news stories paid for by commercialized news-telling. I write for this magazine and many others that I know do diligence to their news-telling and this is not intended to be a slam to that format, I think those news companies who are employing a “story-telling” philosophy and bringing the voices of those people to their pages, podcasts and stories, it’s the smartest thing they could have done.

Personal lesson: Me and my organization are the real deal, and I run with a real deal crew. Get real … it’s the best advice I can give you.

5. Life is short, in business and for real: To live a long life in the mortgage profession, which I have somehow accomplished, staying put is not an easy task. I wrote an article in early 2018 about staying in a “Safe Seat” of musical chairs and gave advice. That advice was never more poignant than this year when the “grass is greener” philosophy and the waving of company flags were being shaken harder than ever before. Volume would be the glue that kept loan officers in their seats and many business development managers found themselves in the hot seats trying to explain slow recruiting because nobody who wasn’t suffering truly where they were was moving. For many mortgage professionals, their homes seem short-lived. The life of the mortgage originator’s job or longevity with a firm, has been truly shortened this past year and movement has been an acceptable thing that hiring firms have learned to accept on resumes that show lots of past employers. That is changing. Everyone is getting into their “Happily Ever After Seats” for the next decade and living their lives in their best way.

Personal lesson: After watching three of my family members weather terminal illnesses, I truly have accepted the shortness of our lives and careers. In the past two years, I have left a firm I worked at for 12 years and started my own company. I turned 50 as I said at the start of this article and I am realizing time is a precious commodity. So, my advice here is simply that we must live our best life and our absolute most genuine life.

Time is of the essence and I think everyone should be operating with the ideology of that every single day. There is no greater piece of advice I can offer to people. I hope you heed this advice.

In ending this short “Blog,” I offer that living in the “Eye of the Storm” this year was beautiful, meaningful, rich in relationship and experience, rewarding and quite frankly far more compelling than sitting on the sidelines. I would highly recommend that you all get out there, out of your seats and out of your comfort zones and get into the mix. There is beauty in the buzz. Be part of the buzz. I feel like this year, I became part of the buzz. I like it. Long live the storm!

Christine Beckwith is a 30-year mortgage industry veteran who has broken many glass ceilings and has blazed a trail for many female professionals to come. Christine is currently president and chief operating officer of 20/20 Vision for Success Coaching and Consulting, a decorated, sought after and award-winning leader. Christine may be reached by e-mail at [email protected].

This article originally appeared in the November 2019 print edition of National Mortgage Professional Magazine.

About the author