Advertisement

The Coronavirus Outbreak Throws a Wrench in the Housing Market, but How Disruptive Will It Get?

The Coronavirus outbreak, which originated in Wuhan but has extended into 162 countries and territories, is now officially a global pandemic. With over 198,000 confirmed cases, a number that changes by the hour, the virus is slowly but surely bringing everything to a grinding halt.

The measures taken to contain its spread, the most important of which seem to be social distancing and home isolation, are leading to one of the most severe economic contractions in recent history or, according to some top economists, to the beginning of a global recession. And this worrying scenario, although it might be too soon to tell, could soon unfold before our eyes.

The measures taken to contain its spread, the most important of which seem to be social distancing and home isolation, are leading to one of the most severe economic contractions in recent history or, according to some top economists, to the beginning of a global recession. And this worrying scenario, although it might be too soon to tell, could soon unfold before our eyes.COVID-19 already has dramatic short-term impact on real estate market

The real estate market was picking up speed, but the Coronavirus outbreak and the measures needed to contain it inflicted a sharp shock to the system, creating ripple effects that will probably extend farther and wider than anyone can anticipate.

With market conditions like low mortgage rates, soaring demand and low inventory across the nation, it seemed the spring of 2020 was going to be one of the most competitive homebuying seasons in a long while. Add to that the strengthening developers’ confidence which, according to a January press release from the National Association of Home Builders, reached “the highest sentiment levels since July of 1999,” and we have the makings of what might have been a strong year for the real estate market.

However, under the new circumstances, interest in real estate is falling and the possibility to buy and sell property is extremely limited. This incipient shift in demand is the most visible upon a closer analysis of Google Trends and real estate portals traffic data.

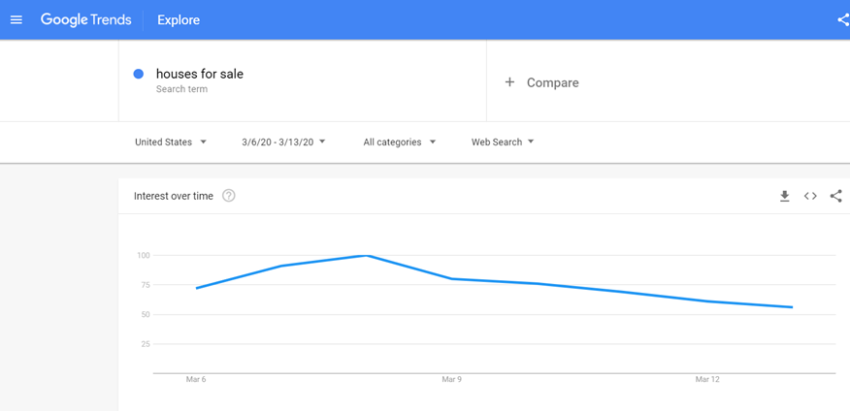

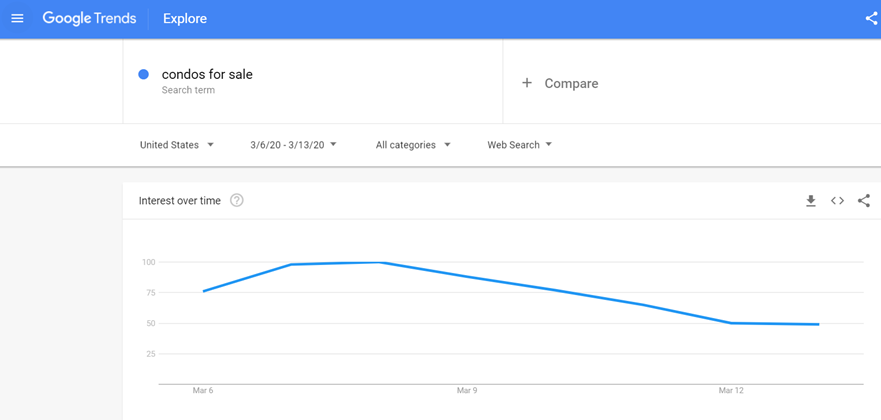

Per Google Trends, consumer interest in real Estate is in free fall

Google Trends data shows a 180 degree-turn in real estate-related searches: interest in “real estate” is plummeting, falling 23 percent in just one week, while searches related to the impact of COVID-19 on homebuying, home selling and construction are increasing.

Since concerns about the new virus and the measures needed to limit its reach have become people’s main preoccupation, and rightly so, day-to-day activities and other interests are pushed to the sides. Social distancing and home isolation are taking over the country, leaving little room for home tours, open houses, negotiations and actual real estate transactions.

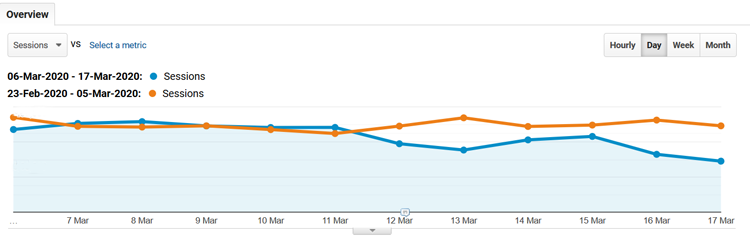

The 35 percent drop in traffic points to shift in homeowners’ interests

Proof of falling interest in homebuying, home selling and renting, traffic on the Point2 Homes platform has seen a marked slowdown. One week was enough for traffic numbers to fall a dizzying 35%. And this change does not take into consideration seasonality. During the spring months, when prices and transactions should start picking up, an event capable of pulling the numbers down so much will definitely have long-term implications.

Just one month prior, like the other signs that were pointing to a strong start of the season, traffic on point2homes.com was steadily climbing. However, the start of the Coronavirus outbreak brought a sudden shift in gears: after a short period of deceleration, visits and other traffic markers saw a dramatic fall.

The first significant drop happened on the 11th of March (-8%), followed by an even sharper decrease the next day (-23%). Visits on the site continued fluctuating, recording the biggest drop (-35%) just four days later, on March 16th. On average, the point2homes.com website saw a decrease in number of visits from prospective homebuyers of 24% in a week.

According to a recent NAR survey, “nearly one in four home sellers nationwide are changing how their home is viewed while the home remains on the market due to the Coronavirus (COVID-19) outbreak,” but the numbers are much higher in Washington and California, the two states that were harder hit by the outbreak. Among the changes, the most important are “stopping open houses, requiring potential buyers to wash their hands or use hand sanitizer (and) asking buyers to remove shoes or wear footies.”

These are the changes already underway in more and more markets across the country. And this seems to be just the beginning. Seeing the immediate consequences of the social and financial measures dictated by the need to contain the outbreak, we wanted to know what industry professionals believe will be the medium- to long-term effects of the pandemic on home prices in particular, and the real estate market in general.

This is why we decided to reach out to agents and real estate professors and ask them about the future of the market, the possible consequences of the fallout and also about how long buyers might be expected to feel the effects of the current slowdown. Here are some thoughts from Dean deTonnancourt, president/CEO HomeSmart Professionals Rhode Island and Maine 2019 President, Rhode Island Association of REALTORS

There will definitely be a slowdown in the market. How do you think this will impact home prices this year?

Dean deTonnancourt: While our focus is to reassure our clients of continued momentum until situations regain normalcy, the market is seeing an impact from the effects of COVID-19. Some sellers are opting to remove their property from the market to avoid visitors into their home. Familial situations and personal concerns are leading factors for this decision. A property listing can be placed in deferred status should a seller choose to suspend showing activities. Similarly, some buyers are affected not only by the current low inventory counts but also by employment gaps caused by mandatory business closures. These circumstances will affect showings activity, and thus closure rates as well as delays in scheduled closings. There is no indication of a loss in property values locally beyond these concerns at this time.

Right now, do you feel that homebuying will get back to what it was before the outbreak soon after it’s done or do you feel its effects will persist long after?

Dean deTonnancourt: As in any market, there are opportunities despite adversity. Interest rates remain low, continuing to adjust daily. This provides an opportunity for home buyers as well as those seeking to refinance. While some home buyers will be forced to delay a purchase due to employment gaps, most buyers who have simply placed their search on hold will likely resume home search activities quickly.

Dean deTonnancourt: As in any market, there are opportunities despite adversity. Interest rates remain low, continuing to adjust daily. This provides an opportunity for home buyers as well as those seeking to refinance. While some home buyers will be forced to delay a purchase due to employment gaps, most buyers who have simply placed their search on hold will likely resume home search activities quickly.

This article appears courtesy of Point2 Homes.

Andra Hopulele is a senior real estate writer at Point2 Homes. With over seven years of experience in the field and a passion for all things real estate, Andra covers the impact of housing issues on our everyday lives. She writes about the financial implications of the new generations entering the housing market and about the challenges of homeownership. Her studies and articles have appeared in publications like REM Online, Yahoo Finance, Which Mortgage, and Le Quotidien. Andra can be reached by e-mail at [email protected].

About the author