Advertisement

NAR Survey: Coronavirus Changing the Way Homes Are Sold

According to a new survey from the National Association of Realtors (NAR), nearly one in four home sellers nationwide are changing how their home is viewed while the home remains on the market due to the Coronavirus (COVID-19) outbreak. The changes include stopping open houses, requiring potential buyers to wash their hands or use hand sanitizer, asking buyers to remove shoes or wear footies, or other changes.

The percentage of sellers adopting these and other changes climbs to 44 percent in Washington State and 34 percent in California, two of the states hardest hit by the Coronavirus.

NAR’s Economic Pulse Flash Survey, conducted March 9-10, asked members questions about how the Coronavirus outbreak, including the significant declines in stock market values and mortgage interest rates, has impacted homebuyer and seller interest and behavior. Several highlights of the member survey include:

►Thirty-seven percent said lower mortgage rates excited homebuyers much more than the stock market correction.

►Almost eight out of 10 (78 percent) said there has been no change in buyer interest due to the Coronavirus.

►Sixteen percent said buyer interest has decreased due to Coronavirus, with members in California and Washington State citing larger decreases in buyer interest–21 percent and 19 percent, respectively.

►Nearly nine in 10 members (87 percent) said Coronavirus has not affected the number of homes on the market.

►Almost eight out of 10 (78 percent) said there has been no change in buyer interest due to the Coronavirus.

►Sixteen percent said buyer interest has decreased due to Coronavirus, with members in California and Washington State citing larger decreases in buyer interest–21 percent and 19 percent, respectively.

►Nearly nine in 10 members (87 percent) said Coronavirus has not affected the number of homes on the market.

In Washington State and California, five percent and four percent of members, respectively, reported homes were removed from the market. That figure stood at three percent for NAR members nationwide.

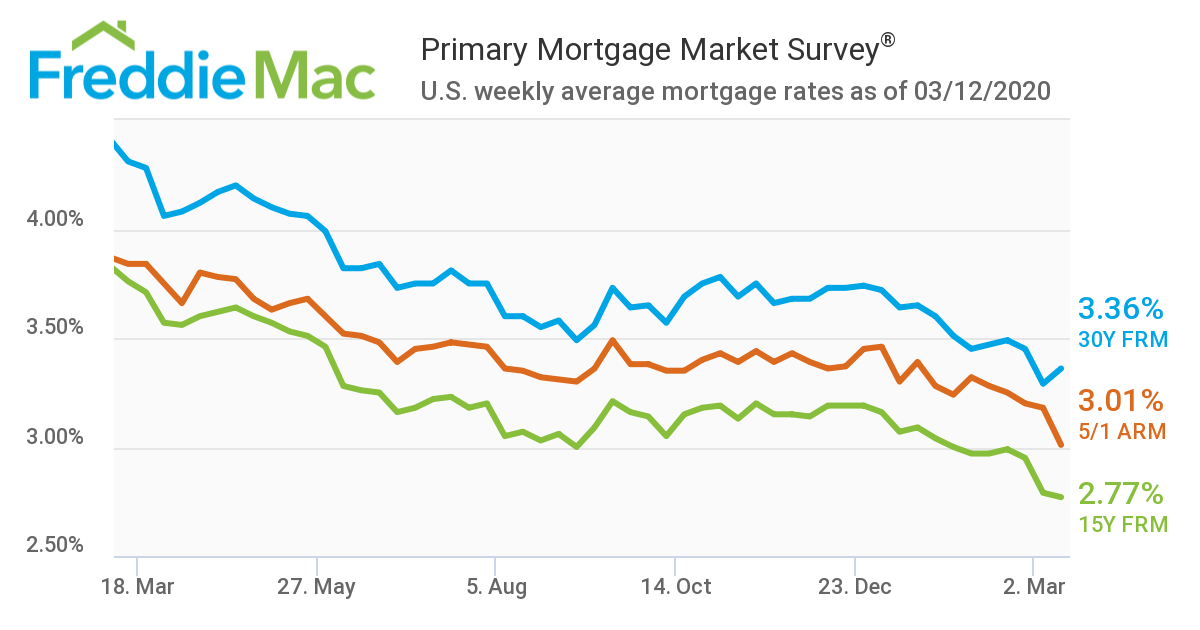

Meanwhile, Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows that the 30-year fixed-rate mortgage (FRM) averaged 3.36 percent with an average 0.7 point for the week ending March 12, up from last week when it averaged 3.29 percent. A year ago at this time, the 30-year FRM averaged 4.31 percent.

“As refinance applications continue to surge and lenders work to manage capacity, the 30-year fixed-rate mortgage ticked up from last week’s all-time low,” said Sam Khater, Freddie Mac’s chief economist. “Mortgage rates remain at extraordinary levels, and many homeowners are smartly weighing their options to refinance, potentially saving themselves money.”

Also this week, the 15-year fixed-rate mortgage averaged 2.77 percent with an average 0.7 point, down slightly from last week when it averaged 2.79 percent. A year ago at this time, the 15-year FRM averaged 3.76 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.01 percent with an average 0.2 point, down from last week when it averaged 3.18 percent. A year ago at this time, the five-year ARM averaged 3.84 percent.

About the author