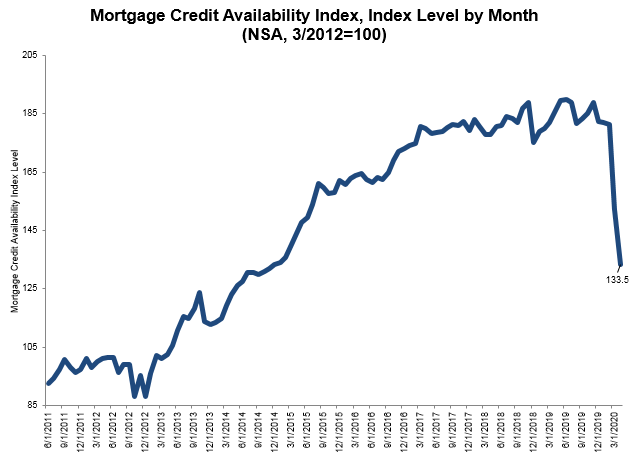

The Mortgage Bankers Association's latest Mortgage Credit Availability Index (MCAI) reported a 12.2% decrease in April 2020, with declining mortgage credit availability directly correlated to the recent tightening of lending standards. The conventional MCAI decreased 15.2% with the government MCAI falling by 9.5%. The Jumbo MCAI fell 22.6% and conforming MCAI followed with a 7.1% decrease.

"The abrupt weakening of the economy and job market—and the uncertainty in the outlook—drove credit availability down in April for the second consecutive month," said Joel Kan, MBA's associate vice president of economic and industry forecasting. "The overall index fell to its lowest level since December 2014, and the sub-indexes pointed to tightened credit supply for all loan types. The decline was largely driven by lenders dropping many low credit score and high-LTV programs, as well as further reduction in jumbo and non-QM products. There was also a large decline in loan offerings pertaining to cash-out refinances, given the GSEs' constraints in purchasing cash-outs that have fallen into forbearance."