Advertisement

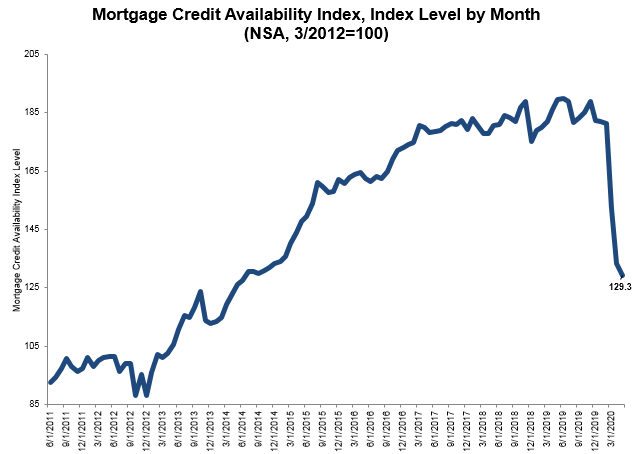

Mortgage Credit Availability Continues To Decline

The Mortgage Bankers Association’s latest Mortgage Credit Availability Index (MCAI) found that mortgage credit availability decreased by 3.1% to 129.3 in May. Last month, the MCAI reported a 12.2% decrease in April, as the impact of COVID-19 was first beginning to hit the housing market.

A decline in the MCAI indicates that lending standards are tightening, while increases in the MCAI are indicative of loosening credit. The Index was benchmarked to 100 in March 2012. The Conventional MCAI decreased 5.7%, while the Government MCAI decreased by 0.8%. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 4.4%, and the Conforming MCAI fell by 6.9%.

“Mortgage lenders in May responded accordingly to the increased risk and uncertainty in the economy. Credit availability continued to decline, with MBA’s overall index now at its lowest level since June 2014,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “There was a reduction in supply across all loan types, driven by further pullback in investors’ appetites for loan programs with low credit scores and high LTVs. Credit tightening was observed at both ends of the market, with less availability of low down payment programs designed for first-time homebuyers, as well as for conforming and non-conforming jumbo loans.”

About the author