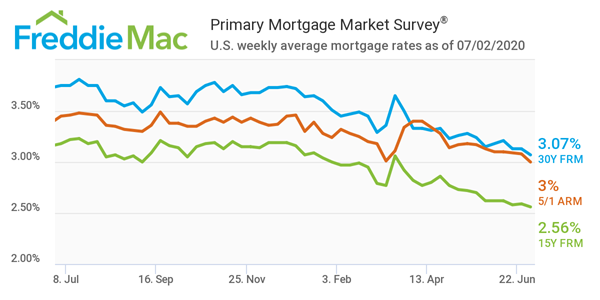

Freddie Mac's Primary Mortgage Market Survey (PMMS) revealed that the 30-year fixed-rate mortgage has hit an average of 3.07% heading into the holiday weekend, the lowest rate in the history of the data series which dates back to 1971.

"Mortgage rates continue to slowly drift downward with a distinct possibility that the average 30-year fixed-rate mortgage could dip below 3.0% later this year," said Sam Khater, Freddie Mac’s chief economist. "On the economic front, incoming data suggest the rebound in economic activity has paused in the last couple of weeks with modest declines in consumer spending and a pullback in purchase activity."

Just a year ago, the 30-year fixed-rate mortgage averaged 3.75%, showing a significant decline in rates year-over-year. The 15-year fixed-rate mortgage averaged 2.56%,

down from 2.59% last week and 3.15% a year ago. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.00%,

down from 3.08% last week and 3.45% a year ago.

The

latest numbers from the U.S. Department of Labor finds that for the week ending June 27, the advance figure for seasonally adjusted initial unemployment claims was 1,427,000, a decrease of 55,000 from the previous week's revised level. The four-week moving average was 1,503,750, a decrease of 117,500 from the previous week's revised average.

"Movement in the right direction is very encouraging nevertheless," said Dr. Lawrence Yun, National Association of Realtors (NAR) chief economist. "The housing market is clearly in a V-shaped recovery and more home construction jobs need to be added. Commercial real estate, however, will lag far behind, especially for office and retail sectors.”