Number Of Borrowers In Forbearance Decline

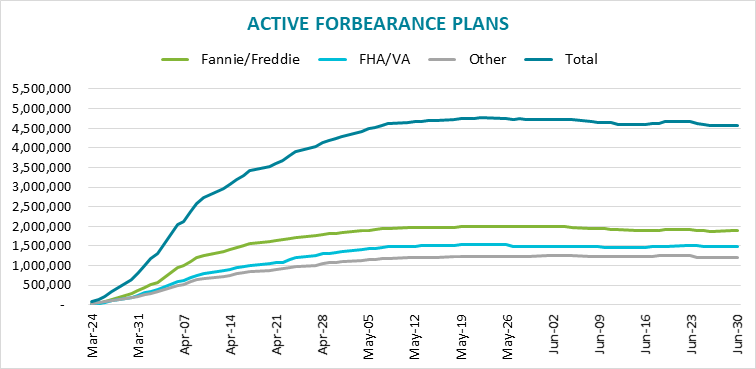

The number of mortgages in forbearance increased in the second to last week of June. However, Black Knight reported a decline in the mortgage forbearances last week. Prior to the previous increase, forbearances saw a three-week period of declines and now look to be back on that course.

The number of active forbearance plans dipped by 104,000 from the previous week: reportedly the lowest weekly total since the first week of May. Black Knight believes this decrease may have occurred as more than half of the active plans, originally set up with a 90-day forbearance, were set to expire in June.

"In any case, as of June 30, 4.58 million homeowners are in forbearance plans, representing 8.6% of all active mortgages, down from 8.8% last week. Together, they represent just under $1 trillion in unpaid principal ($995B)," according to the Black Knight report. "Some 6.8% of all GSE-backed loans and 12.3% of all FHA/VA loans are currently in forbearance plans. Another 9.3% of loans in private-label securities or banks’ portfolios are also in forbearance."

The effect of new COVID-19 cases on the country's economy remains to be seen. Another shutdown could up unemployment numbers and reverse the downward trend for mortgage forbearances.

Read the Black Knight forbearance report.