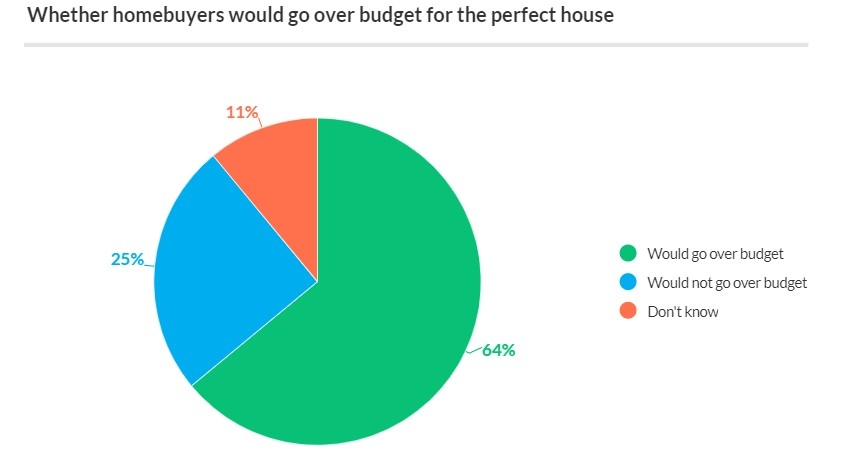

Originators take note: you might be able to convince your clients to take out bigger mortgages. A new survey shows almost two-thirds of Americans are willing to spend more for their dream home. A significant number, though, find the whole process stressful.

A

Lending Tree study says more than 6 in 10 (64%) homebuyers are willing to go over budget for their perfect house.

This sentiment is especially true for millennials, as more than 3 out of 4 (76%) of respondents ages 24 to 39 said they’d stretch their budget to buy their dream home. Seventy-four percent of men agreed.

“I urge homebuyers to be very cautious about going over budget. Many people underestimate the maintenance costs of owning a home,” said Tendayi Kapfidze, LendingTree’s chief economist. “If you are stretched financially and underinvest in maintenance, it can diminish the value of your home.”

Originators should also note how stressful certain groups are about securing their mortgages. Black and Hispanic homebuyers were about twice as likely, at 16% and 18%, respectively, as white buyers (9%) to say applying for a mortgage is the most stressful part of the homebuying process.

More than 1 in 10 (12%) buyers said that they didn’t feel their mortgage lender was effective at explaining their available loan options.