Buyers remorse is the feeling a consumer gets soon after making a purchase. It can be as high as almost 70% with cars, according to AutoTrader. Turns out over half of mortgage recipients share similar feelings.

A new study by

LendEDU claims 55% of homeowners regret taking out a mortgage during the pandemic. Somewhat ironically, a combined 72% cited the coronavirus pandemic as the reason they decided to take out a mortgage to become homeowners, with many specifically attributing the current low-interest-rate lending environment.

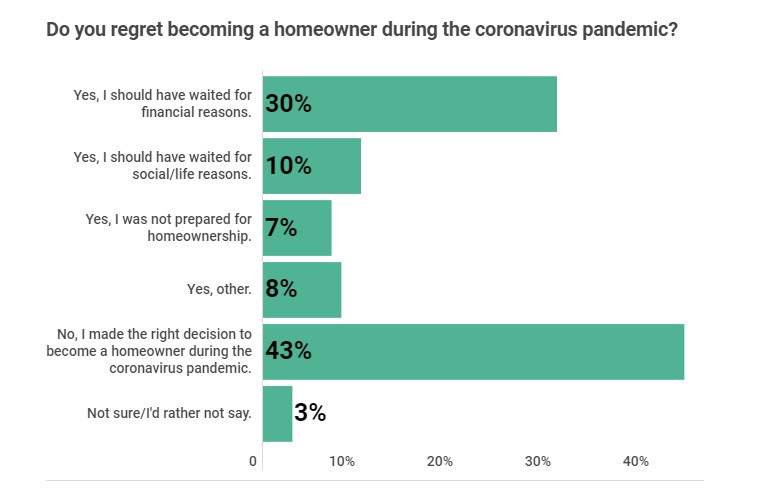

Here are the reasons people feel they should not have become a homeowner during the pandemic:

- Should have waited for financial reasons – 30%

- Should have waited for social/life reasons – 10%

- I was not prepared for homeownership – 8%

- Other – 7%

LendEDU found 26% of all poll participants have refinanced their home loan during the pandemic, while 73% have not, and 1% opted not to say.

Amongst new homeowners specifically, 41% have already refinanced their mortgage to capitalize on the coronavirus interest rates compared to 25% of pre-coronavirus homeowners that have also utilized a mortgage refinance during the pandemic.

And, nearly every single homeowner that has refinanced their mortgage during the pandemic has been able to secure a more favorable interest rate.

When LendEDU asked those homeowners who haven’t refinanced their mortgage during the pandemic why they haven’t done so, 44% said they never considered it, 23% wanted to keep building credit, 8% did not want an appraiser in their home or couldn’t find one, 6% applied but haven’t heard back yet, and 4% applied but were denied.

Other findings from the report include:

- 54% of all homeowners (took out a mortgage either before or during the pandemic) who have agreed to something like pandemic forbearance or a reduced monthly minimum payment have seen incorrect negative marks on their credit report.

- 26% of all homeowners have refinanced their mortgage during the pandemic, with 90% receiving a lower interest rate than before.

- 17% of all homeowners have struggled to pay their mortgage due to getting laid off, while 20% have struggled due to general financial difficulties during the pandemic recession.

- Only 58% of all homeowners indicated they have not struggled to make mortgage payments during the pandemic.

- 16% of all homeowners have agreed to pandemic forbearance with their mortgage lender, while 11% have agreed to a reduced monthly minimum payment. Those percentages are 18% and 25% for only new homeowners.