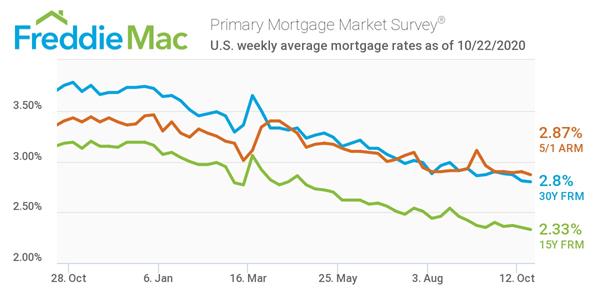

Mortgage Rates Reach Record 2.80 Percent

Freddie Mac's Primary Mortgage Market Survey reported another dip in the 30-year fixed-rate mortgage as it averaged 2.80% as of Oct. 22, 2020. This marks the lowest rate in the Freddie Mac PMMS history. During the same period in 2019, the 30-year fixed-rate mortgage averaged 3.75%.

"Mortgage rates remain very low, providing homeowners who have not already taken advantage of this environment ample opportunity to do so," said Sam Khater, Freddie Mac’s chief economist. "Mortgage rates today are on average more than a full percentage point lower than rates over the last five years. This means that most low- and moderate-income borrowers who purchased during the last few years stand to benefit by exploring refinancing to lower their monthly payment."

The PMMS also revealed that the 15-year fixed-rate mortgage averaged 2.33%, down from 2.35% last week. It remains significantly lower than the 3.18% average for the same period in 2019. Meanwhile, the 5-year Treasury-indexed hybrid adjustable-rate mortgage dipped to 2.87% from 2.90% the previous week.