Allegations Of Fraud Surround Sprout Mortgage Bankruptcy

Court filing reveals millions diverted to Strauss and family, trustee pursues legal action to prevent further misappropriation.

When Sprout Mortgage filed for bankruptcy it was not driven only by market conditions, but allegations that CEO Michael Strauss siphoned off millions of dollars for himself and his family, according to a recent court filing.

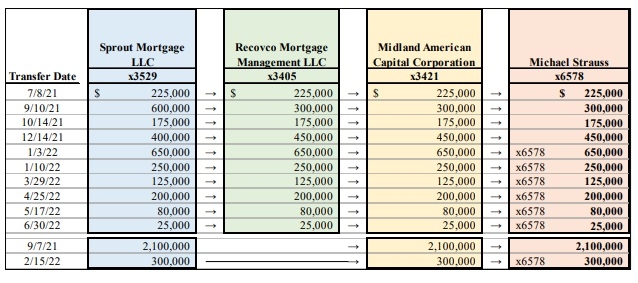

A trustee for Sprout Mortgage reported to the bankruptcy court that millions of dollars were transferred to holding companies and then back to Strauss, his wife, and daughter.

Once Sprout shut down on July 6, 2022 "roughly $2.1 million was transferred into Strauss’ bank account," and some of it was used to make a $100,000 payment to his personal credit card.

"The millions of dollars in payments to Strauss left Sprout in a weakened financial state, by depleting its cash reserves such that the company was left vulnerable against the decline in the real estate market," the trustee wrote. Sprout's "failure and insolvency was caused by Strauss’s longstanding scheme to siphon money out of the business, not simply changing market conditions."

Strauss, according to the court filing, also used funds he funneled from Sprout to pay $2.3 million for homes in New York and the Hamptons; $1.2 million for horse racing and breeding for his daughter, Katherine; $610,000 in American Express related payments, and $69,000 to Southern Methodist University for his daughter Jane.

"From 2020 to September 2022, Strauss directed transfers of funds from the Debtor to Defendants Sprout Membership, Sprout Preferred and Cleek, which, upon information and belief, received net distributions of approximately $7.3 million," Todd Gardella, Sprout's trustee, wrote. "Funds were also funneled into and through Smart Rate, a company owned by Strauss’s wife. The testimony of E. Strauss, however, reveals that she knows very little about her own company and that her husband was really in control and handled the bank accounts. The bank records show that significant funds were transferred here by Strauss personally and through Recovco and KS LLC."

The Non-QM lender, according to insiders, abruptly ended negotiations with Citibank for financing that would have saved the company in 2022. The company was averaging $380 million a month in loan volume when it shut down.

A former wholesale account executive told NMP that the company was trying to sell off $190 million in loans, but was able to sell only $90 million. "Wall Street wasn't buying up Non-QM loans," the account executive said.

The recent court filing says that when it laid off all of its employees it allegedly owed $15.5 million to the Internal Revenue Service for payroll taxes it failed to pay since June 2017. That's at the same time as the company received more than $6.2 million in payroll protection dollars from the federal government.

Since that time former Sprout employees filed their own lawsuit seeking to recover unpaid wages and other compensation. However, a federal bankruptcy judge halted the disbursement of $1.95 million previously allocated for the company's former employees.

In the meantime, the bankruptcy trustee is seeking an injunction against Strauss' family and holding companies to safeguard against further fraudulent moves.