Annual Inflation Slows To 5% In March, A 2-Year Low

March marks the 23rd consecutive month of annual inflation at 5% or above.

Inflation showed additional signs of cooling in March, but likely not by enough to dissuade the Federal Reserve from raising its benchmark interest rate again in May.

The U.S. Bureau of Labor Statistics (BLS) on Wednesday released its monthly report on the Consumer Price Index, which rose 0.1% in March on a seasonally adjusted basis, after a 0.4% monthly increase in February. The 0.1% increase was below the 0.2% increase expected by economists.

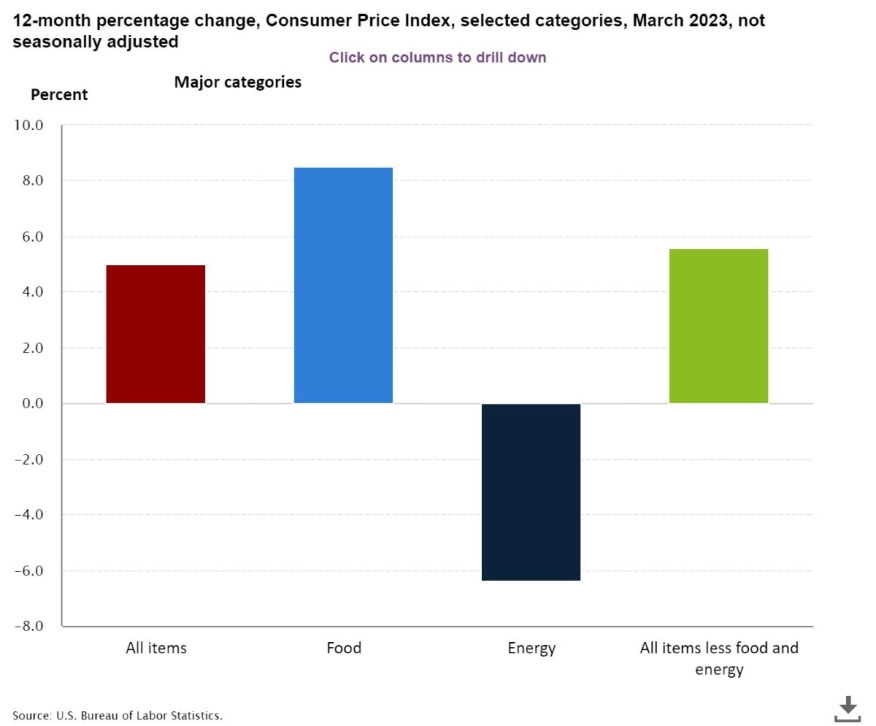

Over the last 12 months, the all-items index increased 5% before seasonal adjustment, the ninth-consecutive decline in the annual rate and the smallest 12-month increase since the period ended May 2021, the BLS said. The 5% annual increase was a significant drop from February’s 6% increase, and was also below the 5.2% annual increase expected by economists.

Still, the 5% annual increase is more than twice the 2% goal set by the Fed. In addition, the U.S. economy has now seen 23 consecutive months with inflation about 5%.

The index for shelter was by far the largest contributor to the monthly all-items increase, the BLS said. It more than offset a decline in the energy index, which decreased 3.5% over the month as all major energy component indexes declined. The food index was unchanged in March, with the food at home index falling 0.3%.

The index for all items less food and energy, considered a measure of core inflation, rose 0.4% in March, after rising 0.5% in February. Indexes that increased in March from a month earlier included shelter, motor vehicle insurance, airline fares, household furnishings and operations, and new vehicles. The index for medical care and the index for used cars and trucks were among those that decreased over the month.

The all-items less food and energy index rose 5.6% over the last 12 months, the BLS said. The energy index decreased 6.4% for the 12 months ended in March, and the food index increased 8.5% over the previous 12 months.

While annual CPI has fallen for nine straight months, with inflation still above 5% it does not "inspire confidence that 2% is just around the corner," Greg McBride, chief financial analyst at Bankrate, told Seeking Alpha.

The gap between the current 5% annual rate and the target 2% rate means another 25-basis-point rate hike will likely be supported during the Federal Open Market Committee's next meeting, scheduled for May 2-3. According to Seeking Alpha, fed funds futures are largely pricing in such an increase, bringing the rate’s target range to between 5% and 5.25%.

“To feel good about where inflation is headed, we need to see more than just moderation in the rate of both headline and core inflation," McBride told Seeking Alpha. "We also need to see moderation in price pressures across a wide range of categories that are staples of the household budget — shelter, food, electricity, motor vehicle insurance, apparel, and household furnishings and operations.”