ATTOM: Zombie Property Count Ticks Upward Again

Despite the uptick, zombie properties still represent just one of every 13,000 residential properties nationwide.

- 284,423 residential properties in the U.S. are in the process of foreclosure in the fourth quarter of this year, up 5.2% from the third quarter of 2022.

- The fourth quarter saw 7,722 'zombie' foreclosures, which are pre-foreclosure properties abandoned by owners.

While you're trick or treating this year it's possible but highly unlikely you'll come across a zombie property.

Zombie properties, pre-foreclosure properties abandoned by owners, represent 7,722 homes across the country this year, according to ATTOM’s Q4 2022 Vacant Property and Zombie Foreclosure Report, released on Thursday.

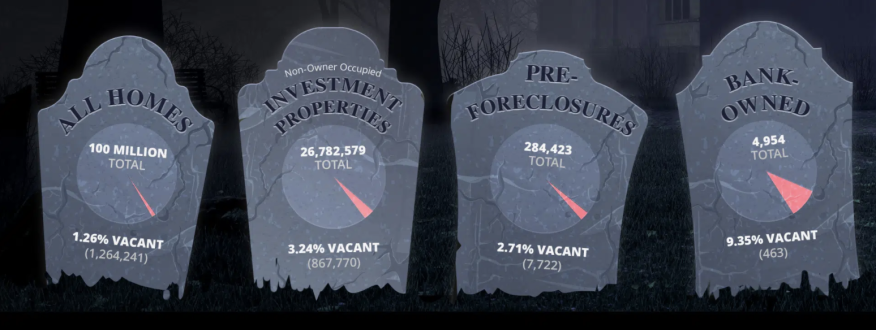

That’s up 0.2% from the prior quarter and 3.9% from a year ago. The count of zombie properties has grown in each of the last three quarters. There are 1.3 million residential properties, which equates to about 1.2 million homes, in the United States sit vacant. That figure represents 1.26%, or one in 79 homes, across the nation.

The report also reveals that 284,423 residential properties in the U.S. are in the process of foreclosure in the fourth quarter of this year, up 5.2% from the third quarter of 2022 and up 27.4% year-over-year.

A growing number of homeowners have faced possible foreclosure since a nationwide moratorium on lenders pursuing delinquent homeowners, imposed after the COVID-19 pandemic hit in 2020, was lifted at the end of July 2021.

“The government’s foreclosure moratorium dramatically reduced the number of properties in foreclosure,” Rick Sharga, executive vice president of market intelligence at ATTOM, said. “Vacant and abandoned properties were among the few homes that could still be foreclosed on during the moratorium, so the number of zombie properties shrank as well. Now that the foreclosure ban has been lifted, we’re likely to see a gradual return to pre-pandemic levels.”

Despite the small increase, the number of zombie-foreclosures remains historically low, representing just a tiny segment of the nation’s total stock of 100.1 million residential properties. In the bigger picture, just one of every 12,963 homes in the fourth quarter of 2022 is vacant and in foreclosure, meaning that most neighborhoods still have no such properties. That ratio is almost exactly the same as in the third quarter of this year, although up 2.5% from the fourth quarter of 2021.

The portion of pre-foreclosure properties that have been abandoned into zombie status continues to decline, from 3.3% a year ago to 2.8% in the third quarter of 2022 and 2.7% in the fourth quarter of this year.

While zombie foreclosures continue to be few and far between in most neighborhoods around the U.S., the biggest increases from the Q3 of 2022 to Q4 of 2022 in states with at least 50 zombie properties are in Kansas, with zombie properties up 32%. On the flip side, the biggest quarterly decreases among states with at least 50 zombie foreclosures are in Michigan, with zombie properties down 23%.

However, the vacancy rate for all residential properties in the U.S. has dropped for three quarters in a row. It now stands at 1.26%, which is equivalent to one in 79 properties, down from 1.28% in the third quarter of 2022 and from 1.33% in the fourth quarter of last year.