Bank of America Earnings Rise 19% YOY

Joins other large U.S. banks in beating analyst expectations.

- Reported net income of $7.4 billion, or 88 cents per diluted share, beating analyst expectations of 84 cents per diluted share.

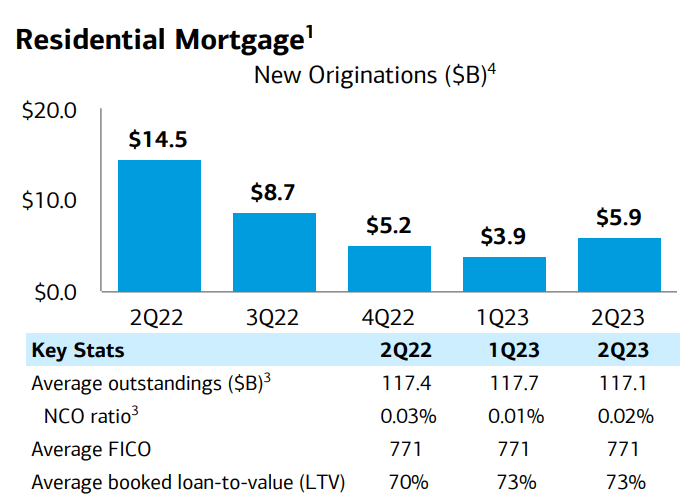

- Residential mortgage originations rebounded to $5.9 billion, up $2 billion, or 51%, from the first quarter.

Bank of America on Tuesday joined the other big U.S. banks in reporting second-quarter results that beat analysts’ expectations.

The nation’s second-largest bank reported net income of $7.4 billion, or 88 cents per diluted share, beating analyst expectations of 84 cents per diluted share.

The second-quarter earnings were also 19% more than the $6.2 billion, or 73 cents per diluted share, reported a year earlier. The results were down 9.8% from net income of $8.2 billion, or 94 cents per diluted share, in the first quarter of this year.

Total revenue, net of interest expense, in the quarter increased 11% from a year earlier to $25.2 billion, though that was down 3% from the first quarter.

Net interest income rose $1.7 billion, or 14%, year over year to $14.2 billion, driven primarily by benefits from higher interest rates and loan growth, the bank said.

Noninterest income of $11 billion increased $795 million, or 8%, year over year as higher sales and trading revenue more than offset lower service charges and investment and brokerage fees, it said.

Residential mortgage originations rebounded in the second quarter to $5.9 billion, up $2 billion, or 51%, from the first quarter. Originations were still down 59% from $14.5 billion in the second quarter of last year.

“We delivered one of the strongest quarters and first-half net income periods in the company’s history,” Bank of America Chairman and CEO Brian Moynihan said. “Continued organic client growth and client activity across our businesses complemented beneficial impacts of higher interest rates and produced an 11% increase in revenue.”

He continued, “We continue to see a healthy U.S. economy that is growing at a slower pace, with a resilient job market. All businesses performed well, and we saw improved market shares, particularly in our Sales and Trading and Investment Banking businesses. A strong balance sheet and ample liquidity allowed us to continue investments in our franchise to drive long-term value for stakeholders.”

Chief Financial Officer Alastair Borthwick agreed.

“Our focus remains on growing our businesses organically by deepening existing client relationships, establishing new relationships, and driving operating leverage,” he said. “We did that again in the second quarter, producing our eighth consecutive quarter of operating leverage.”

Bank of America’s second-quarter results followed on reports released Friday by JPMorgan Chase and Wells Fargo, both of which also beat analyst expectations.

The earnings report also follows an agreement Bank of America reached with federal regulators last week to pay $250 million in fines and compensation to settle claims that it double-charged customers fees, withheld credit card perks, and opened accounts without customer approval.