Black Knight: Rate Lock Volumes Fell 14% In October

Rate lock volume is now down are now down 30% over the past three months and 61% YOY.

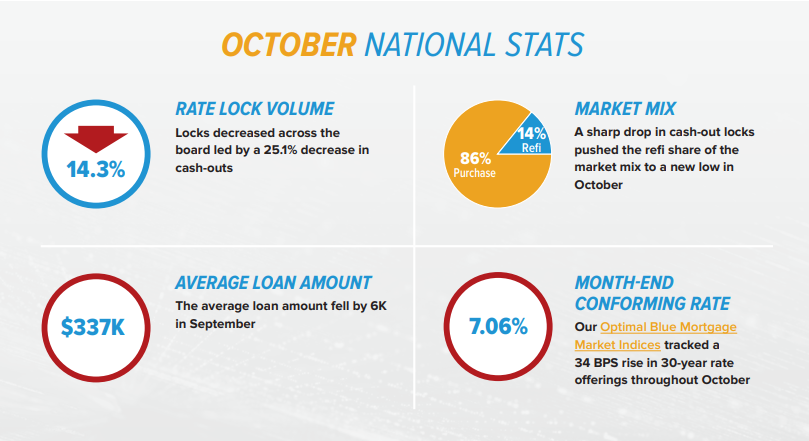

- October’s pipeline data showed overall rate lock dollar volume down 14.3% month over month and at the lowest level since February 2019.

- Rate/term refinance activity fell an additional 15.7% and is down 92.6% year over year.

- Adjustable-rate mortgages (ARMs) have risen to account for 13.1% of October lock activity, up from 11.3% in September.

With mortgage rates rising to their highest level in more than two decades, the overall volume of rate locks fell more than 14% in October, according to Black Knight.

The software, data, and analytics company that serves the mortgage and real estate industries on Monday released its monthly Originations Market Monitor report, looking at mortgage origination data through the end of October.

Black Knight’s Optimal Blue Mortgage Market Indices tracked 30-year mortgage rates as they rose 34 basis points during October to end the month at 7.06%, the highest level since 2002.

With rate locks falling 14% in October, they are now down 30% over the past three months and are 61% below last year’s level, the company said.

“With interest rates now at their highest level in 20 years, the refi market is rapidly approaching a bottom,” said Scott Happ, president of Optimal Blue, a division of Black Knight. “Indeed, our most recent Mortgage Monitor report showed that the number of borrowers with rate incentive to refinance has hit an all-time low of around 130,000, and the vast majority of those are at least 14 years into a 30-year mortgage, with little incentive to restart the clock.”

October’s pipeline data showed overall rate lock dollar volume down 14.3% month over month and at the lowest level since February 2019. The decline was broad-based, but driven by a 25.1% decline in cash-out refinance locks.

With tappable equity near all-time highs earlier in the year, cash-outs had shown some early resilience even as rates began to rise. They’re now down 83.6% from October 2021, Black Knight said.

Rate/term refinance activity fell an additional 15.7% after holding steady in September, and is down 92.6% year over year, Black Knight said. All in all, refinance locks made up just 14% of the month’s activity.

Purchase lending faced continued downward pressure from affordability constraints, with rising rates offsetting recent pullbacks in home prices, Black Knight said. By dollar volume, such locks were down 13% from September and 39% from October 2021.

When looking specifically at the number of purchase locks to exclude the impact of record home-price growth over the last several years, we see it was down 37% year over year and 26% compared to pre-pandemic levels in 2019.

Adjustable-rate mortgages (ARMs) have risen to account for 13.1% of October lock activity, up from 11.3% in September.

“Affordability remains the overarching concern in the mortgage origination market right now,” Happ said. “Despite home prices continuing to pull back in a growing number of markets across the country, the current rate environment means affordability remains a thorny challenge. It’s therefore not very surprising to see a resurgence of somewhat lower-rate loan products like ARMs. Affordability, rates, and home values all factor into falling purchase prices and loan sizes and all are generating headwinds over and above the normal seasonal downturn.”

Other highlights:

- Credit scores fell across the board, with cash-out borrower average scores falling another three points; the average credit score on cash-out refinances is now at 690, 37 BPS lower than the same time last year.

- After seeing a brief uptick In September, both the average purchase price and average loan amount fell in October to $423,000 and $337,000, respectively.