Borrowers Paying More Discount Points for Mortgage Rates May Not Be Worth It, According to Freddie Mac Research

Higher mortgage rates in 2023 led to an increase in borrowers paying discount points, but the benefits may be limited, says Freddie Mac study.

Facing higher borrowing costs, borrowers paid more discount points to buy down their mortgage rate, but they may not be getting the benefit, according to Freddie Mac's latest market outlook.

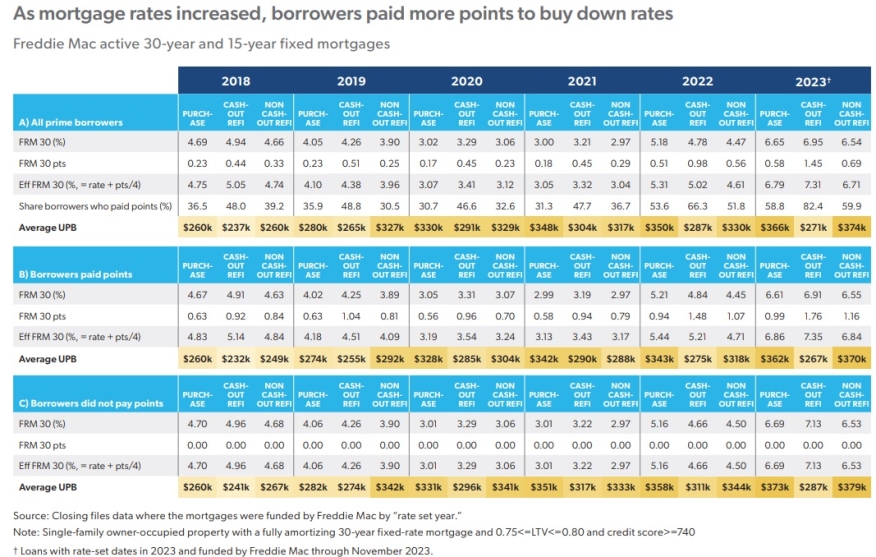

Freddie Mac's research, based on closing data from 2023, delves into the dynamics of borrowers paying discount points to secure lower interest rates. Historically, in a low-interest-rate environment, few borrowers opted for discount points. However, as mortgage rates began to climb in early 2022, an increasing number of borrowers chose to pay these points in a bid to reduce their mortgage rates.

The analysis focused on borrowers whose profiles closely matched those in Freddie Mac's population. Specifically, it considered individuals securing a mortgage for a one-unit, single-family owner-occupied property through a 30-year fixed-rate mortgage. The sample was further restricted to borrowers with conforming loans, credit scores of 740 or higher, and loan-to-value (LTV) ratios ranging from 75% to 80%.

The report found a significant percentage of borrowers opted to pay discount points. For instance, approximately 58.8% of purchase mortgage borrowers chose this option, a substantial increase compared to 2021 and 2022 when only 31.3% and 53.6% of purchase borrowers did the same, respectively. The trend was even more pronounced among non-cash-out and cash-out refinance borrowers, with 59.9% and 82.4% respectively choosing to pay discount points. Furthermore, those who did pay points for refinancing tended to pay higher amounts, averaging 1.16 to 1.76 points.

However, the research highlights an intriguing paradox. While borrowers paying discount points aimed to secure lower mortgage rates, the actual interest rate differential between those who paid points and those who did not was marginal. Through November 2023, the average effective rate for purchase loans was 6.69% for borrowers who did not pay discount points and 6.86% for those who did, indicating that paying discount points may not offer substantial benefits.

Academic research has suggested that paying discount points can be a suboptimal financial decision in many scenarios. However, the study acknowledges that the relationship between discount points and interest rates is influenced by various borrower attributes, both observed and unobserved.

Prime borrowers who chose to pay discount points generally had higher incomes and borrowed larger amounts for home purchases compared to those who did not pay points. These disparities in borrower profiles could contribute to the nuanced relationship between discount points and mortgage rates.

The analysis also revealed regional disparities in borrower behavior, with borrowers in different states displaying varying propensities to pay discount points and origination fees. For instance, in 2023, over 70% of prime purchase borrowers in Hawaii, New Mexico, West Virginia, Oregon, Washington, and Delaware opted for discount points, while fewer than 50% did so in Vermont, Iowa, Massachusetts, Illinois, Nebraska, North Dakota, and Wisconsin.

While the prevalence of discount point payments increased in 2023, the tangible benefits in terms of interest rate reductions appear limited. Freddie Mac says while interest rates stabilize in 2024, the mortgage market will be closely monitored to determine whether the recent uptick in discount point payments becomes a lasting trend or if borrowers opt for alternative strategies in response to changing market conditions.