Borrowers See 1st YOY Decline In Home Equity Since 2012

The 0.7% YOY decline in Q1 is equal to an average loss of $5,400 per borrower from Q1 2022.

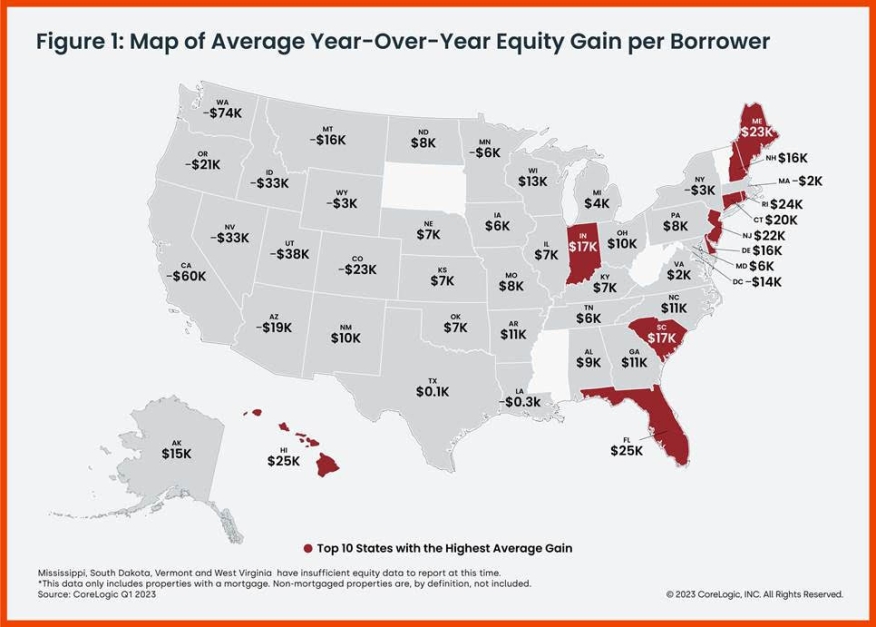

- Mortgage holders in Western states saw the largest year-over-year home equity losses in the U.S., which reflects recent regional price changes.

Home equity for owners with mortgages decreased from a year earlier in the first quarter, the first time since early 2012 there has been even a slight decline year over year, CoreLogic said Thursday.

According to its Homeowner Equity Report (HER) for the first quarter of 2023, homeowners with mortgages — roughly 63% of all properties in the United States — saw their home equity decrease 0.7% year over year. That’s a collective loss of $108.4 billion, or an average loss of $5,400 per borrower since the first quarter of 2022, CoreLogic said.

As they did in the fourth quarter of 2022, Western states posted the largest annual home equity declines, led by Washington (-$74,300), California (-$59,600) and Utah (-$37,700).

The equity losses in those states are a reflection of decelerating home prices, with all three posting annual declines in February and March, according to CoreLogic’s Home Price Index.

Despite the declines, home equity remains solid, with the number of underwater properties unchanged since the fourth quarter of 2022, CoreLogic said. Although some major metro areas saw equity decline year over year, the years of rapid appreciation in places like Los Angeles and San Francisco — which have negative equity shares of 0.9% — is keeping homeowners in these metros in good standing, the report said.

“Home equity trends closely follow home price changes,” said CoreLogic Chief Economist Selma Hepp. “As a result, while the average amount of equity declined from a year ago, it increased from the fourth quarter of 2022, as monthly home prices growth accelerated in early 2023.”

Hepp said the average U.S. homeowner now has more than $274,000 in equity, up significantly from $182,000 before the pandemic.

“Also,” she added, “while homeowners in some areas of the country who bought a property last spring have no equity as a result of price losses, forecasted home-price appreciation over the next year should help many borrowers regain some of that lost equity.”

Negative equity, also referred to as underwater or upside-down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the first quarter of 2023, the quarterly and annual changes in negative equity were:

Quarterly change: From the fourth quarter of 2022 to the first quarter of 2023, the total number of mortgaged homes in negative equity was unchanged at 1.2 million homes, or 2.1% of all mortgaged properties.

Annual change: From the first quarter of 2022 to the first quarter of 2023, the total number of homes in negative equity increased by 4% from 1.1 million homes or 2% of all mortgaged properties.

Because home equity is affected by home price changes, borrowers with equity positions near +/- 5%, the negative equity cutoff, are most likely to move out of or into negative equity as prices change, respectively, CoreLogic said.

Looking at the book of mortgages in the first quarter of 2023, if home prices increase by 5%, 145,000 homes would regain equity; if prices decline by 5%, 213,000 properties would fall underwater, the report said.