Controversy Erupts Over Biden Administration's Title Insurance Waiver

Critics question pilot program's efficacy amidst industry shifts towards alternative solutions.

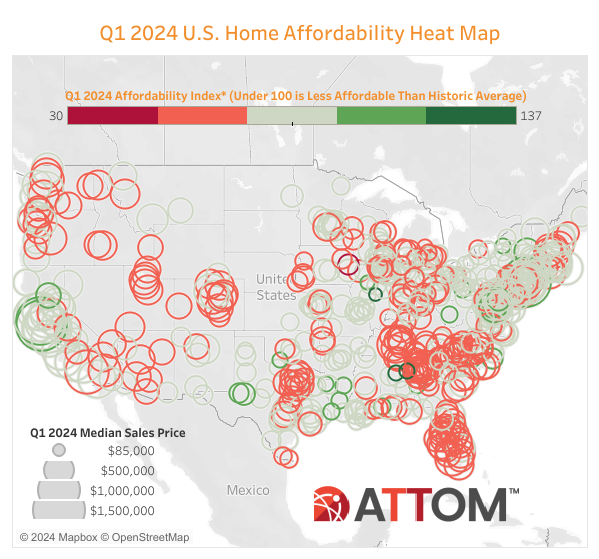

President Joe Biden's initiative to alleviate housing costs includes a pilot program that eliminates the need for lender's title insurance in certain refinancing transactions, according to the White House.

"My administration is also eliminating title insurance on federally backed mortgages. When you refinance your home, you can save $1,000 or more as a consequence," Biden said Thursday during his state of the union address.

However, this move has sparked controversy within the mortgage industry and faces opposition from trade groups. While regulators argue that reducing title requirements would lower closing costs, companies in the title and mortgage sectors contest this claim, citing increased risks.

In a statement released on Thursday afternoon, the White House revealed that the Federal Housing Finance Agency (FHFA) has endorsed policies and pilot programs aimed at reducing closing expenses, including the waiver of lender title requirements.

The program is expected to yield savings of up to $1,000 for thousands of homeowners, with an average of $750, providing substantial relief as mortgage rates decline and more homeowners seek to refinance, according to White House estimates.

Addressing concerns about the risks associated with waiving title requirements, the White House referenced an independent analysis indicating that title insurance typically pays out only 3% to 5% of premiums in consumer claims, compared to over 70% in other insurance sectors.

FHFA Director Sandra Thompson clarified that the pilot program specifically targets low-risk refinance transactions involving lender's title policies or legal opinions and will undergo thorough oversight.

Efforts by government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac to introduce title waiver programs, aimed at enhancing affordability by reducing closing costs, have encountered resistance from trade groups since 2023, citing purported heightened risks.

Thompson emphasized that the pilot does not affect borrowers' title risks, as it applies solely to certain refinance loans where the borrower already holds title to the property, signifying low-risk transactions with confidence in the property's lien-free status.

Moreover, lenders will retain the option to establish clear title through alternative means, such as title insurance or attorney opinion letters (AOLs), while homeowners can opt to purchase their title insurance policy or AOL if desired.

"The approval of this waiver is a hollow attempt by the White House to placate Americans' current economic frustrations," the American Land Title Association said in a press release.

The Mortgage Bankers Association was equally concerned.

"MBA has significant concerns that some of the proposals on closing costs and title insurance could undermine consumer protections, increase risk, and reduce competition," MBA CEO Bob Broeksmit said.