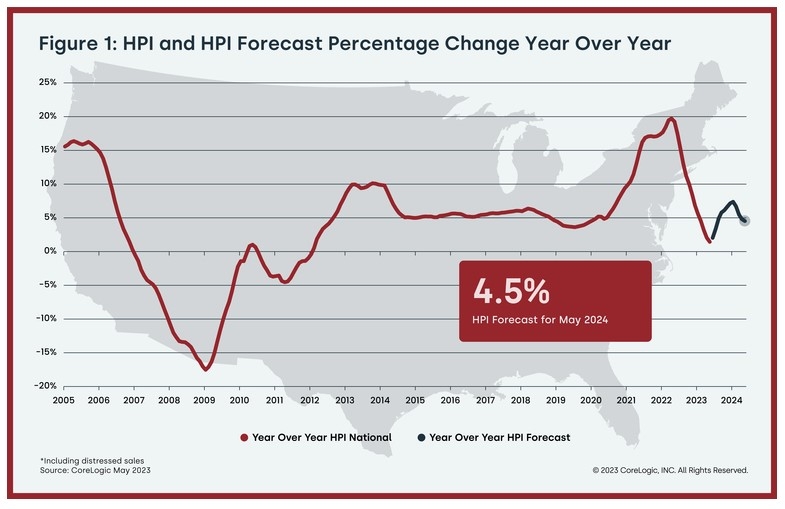

CoreLogic: Annual Home Price Growth Hits Lowest Rate In 11 Years

Annual appreciation projected to regain steam later this year.

- Annual growth fell to 1.4% in May, the lowest since early 2012.

- Prices still increased month-over-month for the 136th consecutive month.

- CoreLogic forecasts show annual U.S. home price gains increasing to 4.5% by May 2024.

Annual U.S. single-family home-price growth slowed for the 12th straight month in May, falling to a 1.4% increase year over year, according to a report from CoreLogic.

The Irvine, Calif.-based global property information, analytics, and data solutions provider released its CoreLogic Home Price Index (HPI) for May 2023 on Monday, which noted that the last time the HPI saw annual growth below 2% was in early 2012. However, price appreciation in May remained positive for the 136th consecutive month, it said.

Following recent trends, a significant number of Western states saw prices decline in May from a year earlier, reflecting migration away from less-urban locations where people moved during the height of the pandemic and the significant loss of affordability due to the resulting home-price surges.

Northeastern states and Southeastern metro areas continue to see larger home-price gains compared to other areas of the country, due to both workers slowly moving back to job centers in some areas of the country and settling in relatively affordable places in others.

“After peaking in the spring of 2022, annual home-price deceleration continued in May,” said Selma Hepp, chief economist at CoreLogic. “Despite slowing year-over-year price growth, the recent momentum in monthly price gains continues in the face of recent mortgage rates increases.”

“Nevertheless,” she continued, “following a cumulative increase of almost 4% in home prices between February and April of 2023, elevated mortgage rates and high home prices are putting pressure on potential buyers. These dynamics are cooling recent month-over-month home price growth, which began to taper and is returning to the pre-pandemic average, with a 0.9% increase from April to May.”

Top Takeaways:

- U.S. home prices (including distressed sales) increased by 1.4% year over year in May from a year earlier. On a month-over-month basis, home prices increased by 0.9% from April.

- In May, the annual appreciation of attached properties (2.7%) was 1.7 percentage points higher than that of detached properties (1%).

- CoreLogic forecasts show annual U.S. home price gains increasing to 4.5% by May 2024.

- Miami again posted the highest year-over-year home-price increase of the country's 20 tracked metro areas in May, at 11.8%. Atlanta and Charlotte, N.C., saw the next-highest gains, both at 4.4%.

- Among states, Maine ranked first for annual appreciation in May (up by 7.2%), followed by New Jersey (+7.1%) and Indiana (+6.9%).

- Eleven states and one district recorded annual home price losses: Idaho (-8%), Washington (-7.5%), Nevada (-5.6%), Montana (-5.3%), Utah (-4.3%), Arizona (-4.2%), California (-3.5%), Oregon (-3.1%), Colorado (-2.7%), South Dakota (-1.3%), New York (-0.3%), and the District of Columbia (-0.1%).

The CoreLogic HPI is built on public record, servicing, and securities real-estate databases and incorporates more than 45 years of repeat-sales transactions for analyzing home price trends. With an average five-week lag, the CoreLogic HPI is designed to provide an early indication of home-price trends by market segment and for the single-family combined tier.