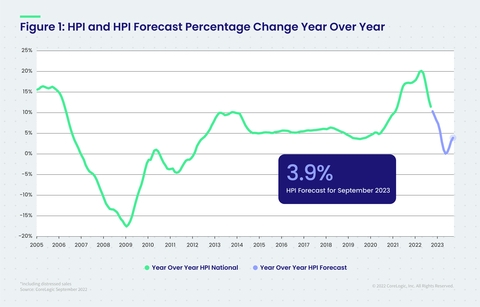

CoreLogic: Home Prices Grew Annually by 11.4%

They're expected to slow to 3.9% by September 2023.

While home price growth continued to slow around the United States, to about an 11.4% on an annual basis in September, home prices in at least three southeastern states, Florida, South Carolina and Tennessee, outpaced the nation, according to housing data provider CoreLogic.

Florida led the increase, posting an annual price gain in September of 23%, with South Carolina and Tennessee coming in at 17.6% and 17.4%, respectively.

“The rapid increase in prices during the COVID-19 pandemic caused many U.S. housing markets to reach completely unaffordable levels for potential local homebuyers” CoreLogic economist Selma Hepp said. “On the West Coast and in the Mountain West states, home prices are slowing from this spring’s high but remain elevated from a year ago.

“By contrast,” she continued, “markets that continue to see an in-migration of higher-income households are still experiencing home price gains that are notably higher than the national rate of appreciation.”

Despite the recent growth in housing prices, CoreLogic predicts housing prices will grow by only 3.9% between September 2022 and September 2023.

In September 2022, annual price appreciation of detached properties was 11.5%, while attached properties grew on an annual basis by 11.1%.

Among metropolitan markets, Miami posted the highest year-over-year price growth, coming in at 25.6% while another Florida market, Tampa, remained at number two in price appreciation at 23.2%, CoreLogic reported.

“Although rising mortgage rates continue to dampen housing demand nationwide, out-migration from more expensive states on the West Coast and in the Northeast is likely fueling homebuyer enthusiasm for properties in relatively more affordable Southeastern states,” CoreLogic reported.