CoreLogic: Mortgage Delinquency Rate Holds Steady At 3.1% In December

Despite overall stability, 17 states witness yearly increases; concerns arise over consumer credit performance amidst economic shifts.

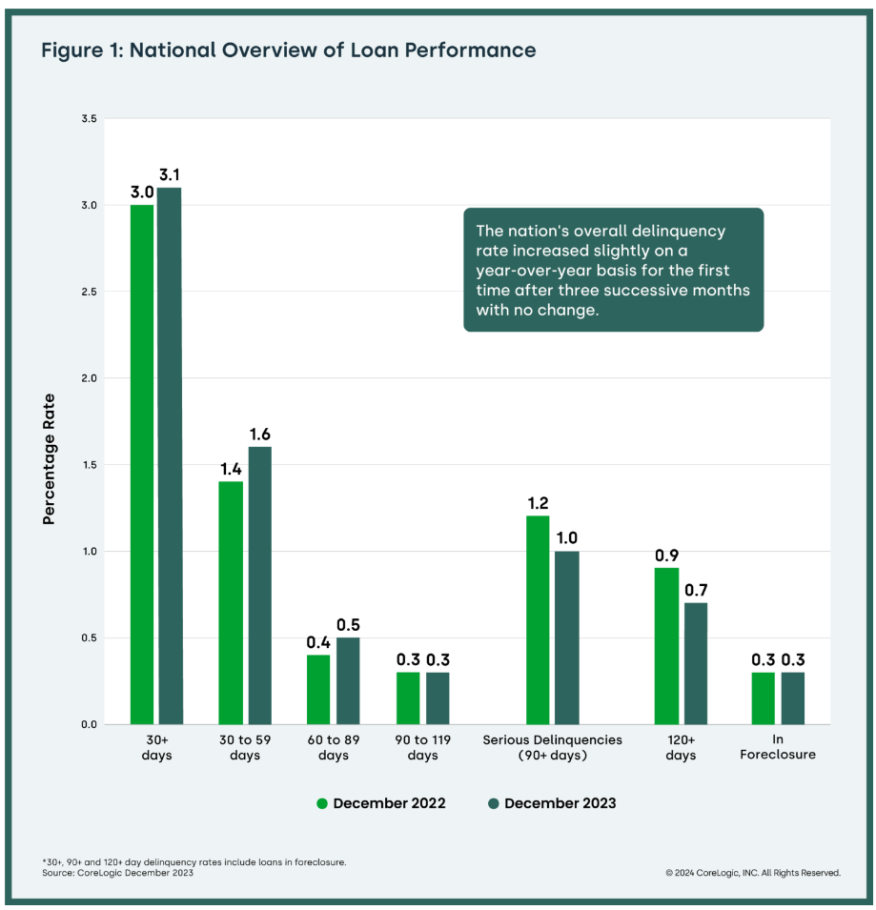

In December 2023, the national mortgage delinquency rate in the United States remained at 3.1%, in line with figures reported since the spring of 2022, according to the latest CoreLogic report.

Despite the overall stability, the report highlighted slight increases in delinquency rates across 17 states, with Louisiana and Hawaii leading the pack with respective increments of 0.4 and 0.3 percentage points. The foreclosure rate held steady at 0.3%, marking its 22nd consecutive month at this level.

- Early-Stage Delinquencies: Rose to 1.6% from 1.4% in December 2022.

- Adverse Delinquency: Increased to 0.5% from 0.4% in December 2022.

- Serious Delinquency: Declined to 1% from 1.2% in December 2022.

- Foreclosure Inventory Rate: Remained unchanged at 0.3%.

- Transition Rate: Climbed to 0.9% from December 2022.

“Early-stage mortgage delinquency rates increased in December 2023 from one year earlier but remained near historic lows," CoreLogic Principal Economist Molly Boesel said. “There were offsetting declines of home loans that were six months or more past due, which led to a drop in the serious delinquency rate.”

But that's not what is troublesome.

"Other types of consumer credit showed increases in serious delinquency rates at the end of 2023,” Boesel said. “The Federal Reserve reports that the number of credit-card and automobile-loan transitions moving into serious delinquency were above pre-pandemic levels, which could be a signal of increased financial stress for some Americans.”

On a regional level:

Seventeen states observed yearly increases in overall mortgage delinquency rates, with the most substantial gains seen in Louisiana and Hawaii.

One hundred fifty-nine U.S. metro areas witnessed upticks in year-over-year delinquency rates, notably Kahului-Wailuku-Lahainia, Hawaii, and New Orleans-Metairie, Louisiana.

Three metro areas reported annual increases in serious delinquency rates, including Kahului-Wailuku-Lahainia, Hawaii.

While the overall mortgage delinquency rate maintained its stability, concerns persist over potential economic shifts and their impact on consumer credit performance.