Delinquency Rates Fall And Foreclosures Hit An All-Time Low

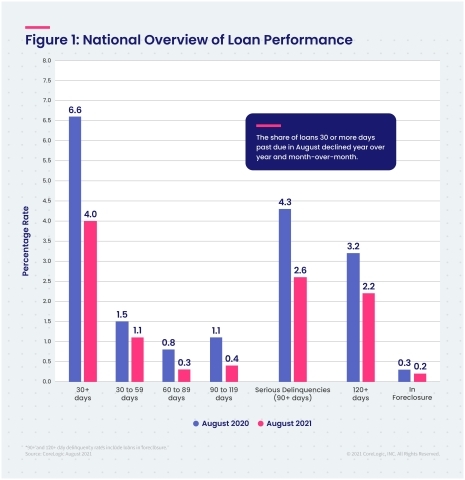

In August, 4% of all mortgages were in some stage of delinquency, decreasing 2.6 percentage points.

- Early-stage delinquencies (30 to 59 days past due) represent 1.1% of all delinquent mortgages, down from 1.5% in August 2020.

- Adverse delinquencies (60 to 89 days past due) represent 0.3%, down from 0.8% in August 2020.

- Serious delinquencies (90 days or more past due, including loans in foreclosure) represent 2.6%, down from 4.3% in August 2020.

- The share of mortgages in some stage of the foreclosure process represent 0.2% of all delinquencies, down from 0.3% in August 2020 — the lowest foreclosure rate recorded since CoreLogic began recording data in 1999.

Corelogic released their Loan Performance Insights report for August 2021, showing that 4% of all mortgages were in some stage of delinquency, decreasing 2.6 percentage points compared to August 2020. Those who are delinquent include persons 30 or more days past due on mortgage payments and those in foreclosure.

Broken down by stages, early-stage delinquencies (30 to 59 days past due) make up 1.1% of all delinquent mortgages, down from 1.5% in August 2020. Adverse delinquencies (60 to 89 days past due) represent 0.3%, down from 0.8% in August 2020. Serious delinquencies (90 days or more past due, including loans in foreclosure) represent 2.6%, down from 4.3% in August 2020.

Meanwhile, the share of mortgages in some stage of the foreclosure process represent 0.2% of all delinquencies, down from 0.3% in August 2020. This remains the lowest foreclosure rate recorded since CoreLogic began recording data (1999). The share of mortgages that transitioned from current to 30 days past due represent 0.6%, down from 0.9% in August 2020.

“The decline in the overall delinquency rate to its lowest since the onset of the pandemic is good news, but it masks the serious financial challenges that some of the borrower population has experienced,” said Dr. Frank Nothaft, chief economist at CoreLogic. “In the months prior to the pandemic, only one-in-five delinquent loans had missed six or more payments. This August, one-in-two borrowers with missed payments were behind six-or-more monthly installments, even though the overall delinquency rate had declined to the lowest level since March 2020.”

Facing slower than anticipated employment growth, August saw an increase of only 235,000 new jobs compared to an expected 720,000. As a result, households have found creative ways to cut back on spending to prioritize mortgage payments. According to the Corelogic survey, over 30% of respondents said they would cut back on both entertainment and travel to focus on repaying outstanding debt. Meanwhile, income growth and the build-up of home equity wealth will be important parts of financial recovery for borrowers hit hardest by the pandemic.

“The unprecedented fiscal and monetary stimuli that have been implemented to combat the pandemic are pushing housing prices and home equity to record levels,” said Frank Martell, president and CEO of CoreLogic. “This phenomenon is driving down delinquencies and fueling a boom in cash-out refinancing transactions.”

All states saw year-over-year declines in delinquency rates in August 2021. States that saw the largest year over year declines were New Jersey (down 4 percentage points); Florida (down 3.8 percentage points); and Nevada (down 3.6 percentage points). All other states experienced decreases between negative 1.3 and negative 3.3 percentage points.

Additionally, all U.S. metropolitan areas posted at least a small annual decrease in their overall delinquency rate. The largest annual decreases were in Laredo, Texas (down 6.3 percentage points), Miami-Fort Lauderdale-Pompano Beach, Florida (down 5.7 percentage points), McAllen-Edinburg-Mission, Texas (down 5.3 percentage points) and Atlantic City-Hammonton, New Jersey (down 5 percentage points).

The next CoreLogic Loan Performance Insights Report will be released on December 14, 2021, featuring data for September 2021.