Despite Challenges, Homebuyers Respond Positively To Lower Interest Rates

Mortgage rates dip slightly, prompting increase in home loan applications.

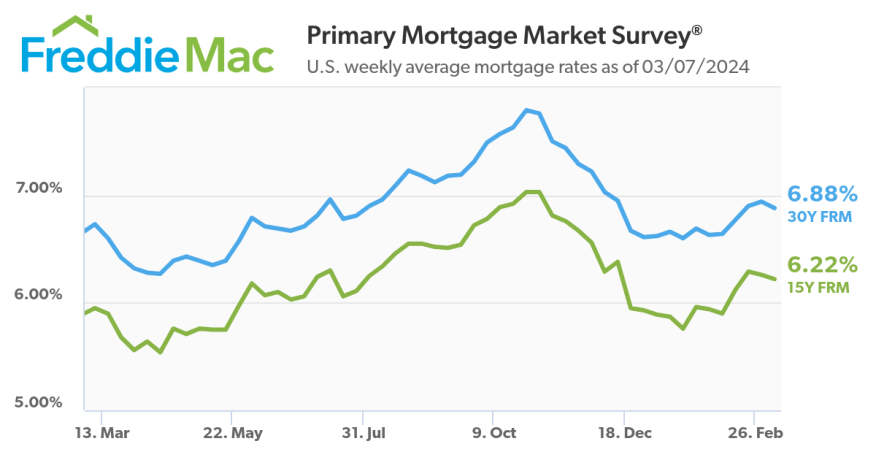

In a slight reprieve for potential homebuyers, the 30-year fixed-rate mortgage dipped to 6.88%, down from last week's 6.94%, according to data from Freddie Mac. This drop sparked an uptick in mortgage applications, breaking a six-week trend of decline.

"Evidence that purchase demand remains sensitive to interest rate changes was on display this week, as applications rose for the first time in six weeks in response to lower rates,” Freddie Mac's Chief Economist Sam Khater said. "Mortgage rates continue to be one of the biggest hurdles for potential homebuyers looking to enter the market. It’s important to remember that rates can vary widely between mortgage lenders so shopping around is essential."

The 30-year FRM averaged 6.88%, down from last week's 6.94%. One year ago, it stood at 6.73%.

The 15-year FRM saw a decrease to 6.22% from 6.26% the previous week. In comparison, it averaged 5.95% a year ago.

"A small decline in mortgage rates last week led to a nearly 10-percent jump in mortgage applications, with refinance and purchase activity both posting solid gains," Mortgage Bankers Association CEO Bob Broeksmit said. "Housing inventory remains tight and home prices are elevated, but first-time buyer interest is strong this spring. FHA purchase applications jumped 16 percent.”

Throughout February, mortgage rates experienced a slight increase due to robust inflation and economic reports, sparking speculation among bond investors about the Federal Reserve's interest rate policy. Federal Reserve Chair Jerome Powell hinted at potential rate cuts later this year but emphasized the need for evidence of inflation stabilization. Despite this, the Fed's main interest rate remains at its highest level since 2001.

Despite the fluctuating trajectory, the average rate on a 30-year home loan has decreased from its late October peak of 7.79%. This decline has provided relief for homebuyers grappling with escalating prices and limited housing inventory.

Lower rates contributed to a 3.1% increase in sales of previously owned U.S. homes in January, marking the strongest sales pace since August.