Empowering Mortgage Professionals With An AI Homebuying Marketplace

Faster time to close on transactions

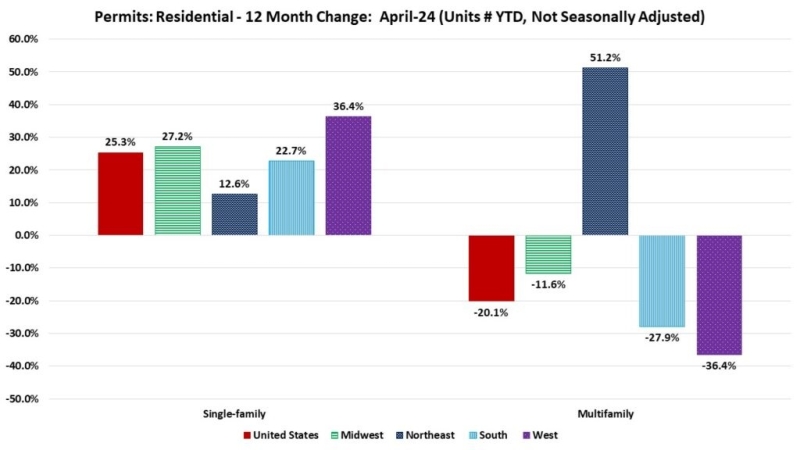

Today's mortgage industry presents a myriad of obstacles for brokers, lenders, and loan officers. With interest rates at elevated levels compared to recent years, the demand for home refinancing has significantly dwindled. Concurrently, soaring home prices have impeded the home purchase market, particularly affecting first-time homebuyers and underserved communities. In this landscape, securing customer leads has become a formidable task for mortgage professionals.

Compounding these market challenges are persistent technological and procedural hurdles within the mortgage process itself. Despite substantial investments, outdated technologies and manual processes persist, leading to errors, risks, and inflated costs. Customers face fragmented services, complex loan applications, and language barriers, contributing to low satisfaction levels across the industry.

Moreover, fluctuating demand and operational costs pose an ongoing challenge for mortgage brokers and lenders in adjusting loan officer capacity. Flexibility during market fluctuations remains elusive, with traditional full-time employment structures proving inefficient.

Introducing Finaya: A Game-Changing Solution For Consumers and Mortgage Professionals

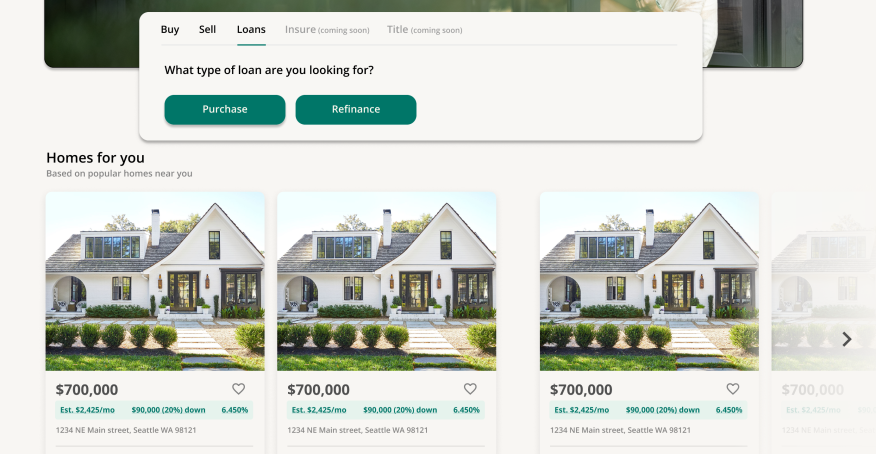

Enter Finaya. On May 22, 2024, Finaya unveiled its revolutionary AI-powered homeownership marketplace super-app. The vision behind the super-app is to provide a seamless, digital-first experience encompassing real estate transactions, mortgages, insurance, and other related services. Leveraging cutting-edge AI technologies, Finaya aims to automate processes, optimize pricing, and enhance the customer experience.

Six Benefits of Finaya for Mortgage Professionals

Finaya offers a game-changing solution for both consumers and industry professionals. Here's how it benefits mortgage professionals specifically:

- Access to In-Market Customers: Finaya connects mortgage professionals directly with active homebuyers and borrowers, streamlining lead generation and saving time and resources.

- Support for Underserved Customers: Through its comprehensive "Learn" section, Finaya educates customers on home buying and assistance programs, expanding opportunities for all parties involved.

- Automation: Finaya progressively automates tasks, reducing manual efforts for mortgage professionals and facilitating smoother application processes.

- Transparency in Transactions: The super-app facilitates transparent data sharing across all parties involved in a real estate transaction, enhancing visibility for mortgage professionals.

- Flexible Capacity Management: Mortgage professionals can manage capacity based on demand fluctuations, ensuring efficiency in resource allocation.

- Attractive Business Model: Finaya offers its technology and data at no upfront cost, with mortgage professionals paying a share of commissions only upon successful funding, mitigating financial risks.

Finaya represents a transformative force in an industry grappling with challenges. Mortgage brokers and lenders, for more info contact us here.