Ex-Countrywide CEO Angelo Mozilo Dies At 84

Leaves a mixed legacy of being an industry leader only to become the face of the 2008 subprime crisis.

It’s difficult to discuss Angelo Mozilo’s legacy without talking about the subprime crisis of 2008.

The founder, chairman and CEO of Countrywide Financial died Sunday at age 84, and to the end denied that he bore any responsibility for the financial meltdown.

First reported by The Chrisman Commentary, a daily newsletter for the mortgage industry, Mozilo’s death was confirmed by the Mozilo Family Foundation website and a close friend.

David H. Stevens, a former president and CEO of the Mortgage Bankers Association who knew Mozilo well, said Monday that, despite the 2008 crisis, Mozilo deserves to be remembered in a more positive light.

“This is a time people should respect the legacy this man built,” said Stevens, who also is a former U.S. assistant secretary at the Department of Housing and Urban Development. “Pointing to the housing crisis is unfair. Everybody was chasing Countrywide.”

A Butcher's Son

Born in the Bronx, Mozilo was the son of a butcher who went on to earn a Bachelor of Science degree from Fordham University. He and his former mentor later founded Countrywide Credit Industries in New York.

They eventually relocated the business to California, where they also co-founded IndyMac Bank, originally known as Countrywide Mortgage Investment. The bank was spun off as an independent bank in 1997. It later collapsed and was seized by federal regulators in July 2008.

Still, Countrywide was considered a pioneer in the non-bank mortgage industry, up until it began offering subprime mortgages in the early 2000s in order to keep up with competitors.

When the subprime mortgages eventually led to the financial crisis of 2008, Mozilo and Countrywide were targeted as one of the culprits, both in the news media and by federal regulators.

Mozilo and two former Countrywide executives eventually agreed to pay $67.5 million to the Securities and Exchange Commission (SEC) — without any admission of wrongdoing — to avoid a trial on charges of insider trading and civil fraud. The agreement was announced in October 2010.

The SEC investigation also dug up information about a VIP program dubbed "Friends of Angelo." The program provided sweetheart loans for government officials, including Chris Dodd, the former U.S. Senator from Connecticut who chaired the Banking Committee at the time. Dodd and his wife denied any knowledge that they had received preferential treatment on their three loans.

Following a three-year Congressional inquiry, four other lawmakers were referred to the House Ethics Committee for receiving similar treatment, but no charges were ever filed.

The U.S. Justice Department later agreed, in February 2011, to drop a two-year criminal investigation into Mozilo on charges of insider trading.

'We Were An Easy Mark'

Still, as late as May 2019, when Mozilo spoke at the SALT Conference for hedge fund executives in Las Vegas, he rejected the notion that he bore any guilt for the subprime crisis.

“Somehow, for some unknown reason, I got blamed for it,” Mozilo said during the conference, adding that he and his Countrywide team “didn’t deserve the reputation they were given. Because we were the largest involved, because we were so visible, because I was so visible, we were an easy mark,”

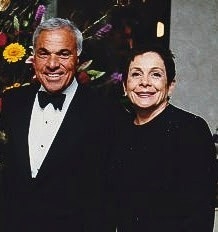

Mozilo also noted at the time the increasing distance between the 2008 crisis and his 2019 world. “A lot of years went by, my wife passed away, I turned 80-years-old, and now I don’t care,” he said.

Phyllis Mozillo, with whom he had five children, died in 2017.

'An Icon'

Stevens said Mozilo’s legacy is more than just the financial crisis.

“I knew Angelo pretty well during his Countrywide days,” he said during a telephone interview with NMP. “I ran the single-family business at Freddie Mac for almost a decade. [Countrywide] did the majority of their business with Fannie Mae, but they were still our second-largest customer, which tells you how big they were.”

He and Mozilo had dinners together during that time, "sometimes with our spouses, where he would lecture me about loan repurchases," Stevens said with a chuckle.

He also stressed that, before the crisis, Mozilo was an icon of the industry and a much sought-after speaker.

“Whatever anybody wants to say about the housing crisis, [Angelo] built Countrywide from the ground up … to make it the nation’s largest lender,” Stevens said.

Ultimately, he said, Mozilo and Countrywide were the leaders in the industry “that every other company in America had to chase competitively.”

”I know that, towards the end, his family was surrounding him over the weekend,” Stevens said. “Anybody who knows the family knows his kids are in the business, and that’s part of his legacy.”

He added that, in 2008, “We all went off the same cliff together as an industry, but we should remember the man for his inventiveness, his leadership. He was a true legacy and icon for any of us old dogs who have been in this industry for decades.”