FairPlay Study Ranks Fairest Lenders & Metro Areas In U.S.

Mortgage fairness increased for the protected classes in 2021, but regional inequalities persist.

- Native American homebuyers were approved for mortgages at 81.9% the rate of white homebuyers.

- Black homebuyers were approved for mortgages at 84.4% the rate of white homebuyers.

- Hispanic homebuyers are approved for mortgages at 88.7% the rate of white homebuyers.

- Female homebuyers were approved for mortgages at 99.2% the rate of male homebuyers, the highest rate ever and approaching parity.

For the second year, FairPlay released its comprehensive study evaluating publicly available data to identify the fairest cities and fairest lenders in the United States. The data analyzes loan records from 2021 for four protected groups including Black, Native American, Hispanic, and female borrowers.

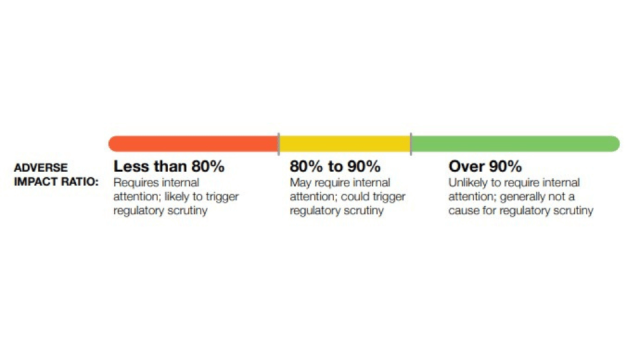

To determine fairness, FairPlay data scientists calculated the Adverse Impact Ratio (AIR) for each of the four protected groups across the Top 20 metro areas and the country’s largest lenders. For example, if protected class applicants had a 60% approval rate, while the control group had a 90% approval rate, the AIR would be 60/90 or 67%. An AIR of less than 80% is considered a statistically significant disparity. AIR does not control for risk.

The analysis shows that mortgage fairness increased for the protected classes in 2021, but regional inequalities persist, particularly for Black and Native American borrowers.

"In this analysis, we've identified lenders who are successfully underwriting applicants from historically disadvantaged groups, to give more people a fair shot at achieving the American Dream," said Kareem Saleh, FairPlay founder and CEO.

The study covers more than 23 million mortgage applications from 2021. The loan records were obtained from federal public source data in the Home Mortgage Disclosure Act (HMDA). This is the most comprehensive publicly available data source that identifies race, ethnicity, and gender for mortgage applications.

In 2021, Native American homebuyers were approved for mortgages at 81.9% the rate of white homebuyers. They experienced the lowest approval rates for mortgages in the Southwest, particularly in Arizona and New Mexico.

The Top 10 Fairest Cities for Native American Homebuyers:

- Miami

- San Francisco

- Seattle

- Boston

- Minneapolis

- San Diego

- Las Vegas

- Detroit

- Fort Worth

- Los Angeles

The Top 10 Fairest Lenders for Native American Homebuyers:

- Primary Residential Mortgage

- Huntington National Bank

- Paramount Residential Mortgage

- Prosperity Home Mortgage

- Home Point Financial

- Union Home Mortgage

- Lakeview Loan Servicing

- Caliber Home Loans

- Loandepot.com

- Cornerstone Home Lending

In 2021, Black homebuyers were approved for mortgages at 84.4% the rate of white homebuyers — the highest rate ever. Black homebuyers experience the lowest approval rates for mortgages in the South and the Midwest, as well as in rural areas.

The Top 10 Fairest Cities for Black Homebuyers:

- San Diego

- Portland

- Seattle

- San Francisco

- Tampa

- Denver

- Miami

- New York

- Minneapolis

- Phoenix

The Top 10 Fairest Lenders for Black Homebuyers:

- Gateway First Bank

- Lakeview Loan Servicing

- Planet Home Lending

- Bank of America

- Community Bank

- Movement Mortgage

- Rocket Mortgage

- Nationstar Mortgage

- Guild Mortgage

- Primelending

In 2021, Hispanic homebuyers are approved for mortgages at 88.7% the rate of white homebuyers. Hispanic homebuyers experienced the lowest mortgage approval rates in rural areas.

The Top 10 Fairest Cities for Hispanic Homebuyers:

- Denver

- Minneapolis

- Seattle

- Dallas

- Portland

- Chicago

- San Diego

- San Francisco

- Washington, D.C.

- Boston

The Top 10 Fairest Lenders for Hispanic Homebuyers:

- Lakeview Loan Servicing

- Gateway First Bank

- Huntington National Bank

- Cardinal Financial

- Homebridge Financial Services

- Academy Mortgage

- Loandepot.com

- Guild Mortgage

- Movement Mortgage

- CMG Mortgage

In 2021, female homebuyers were approved for mortgages at 99.2% the rate of male homebuyers — the highest rate ever and approaching parity.

The Top 10 Fairest Cities for Female Homebuyers:

- New York

- Seattle

- Boston

- Portland

- San Francisco

- San Diego

- Los Angeles

- Minneapolis

- Miami

- Denver

The Top 10 Fairest Lenders for Female Homebuyers:

- Bank of America

- Fifth Third Bank

- Wells Fargo Bank

- Truist Bank

- Guaranteed Rate Affinity

- JPMorgan Chase Bank

- Finance of America Mortgage

- US Bank

- Guaranteed Rate

- Community Bank

In addition to reading the study, you can listen to the next episode of NMP’s podcast Gated Communities, in which Saleh, FairPlay's CEO, discusses the study’s findings in more depth.