Fannie Mae: Home Price Growth Continues To Surprise

Quarterly index shows nearly 8% growth on a seasonally adjusted annualized basis.

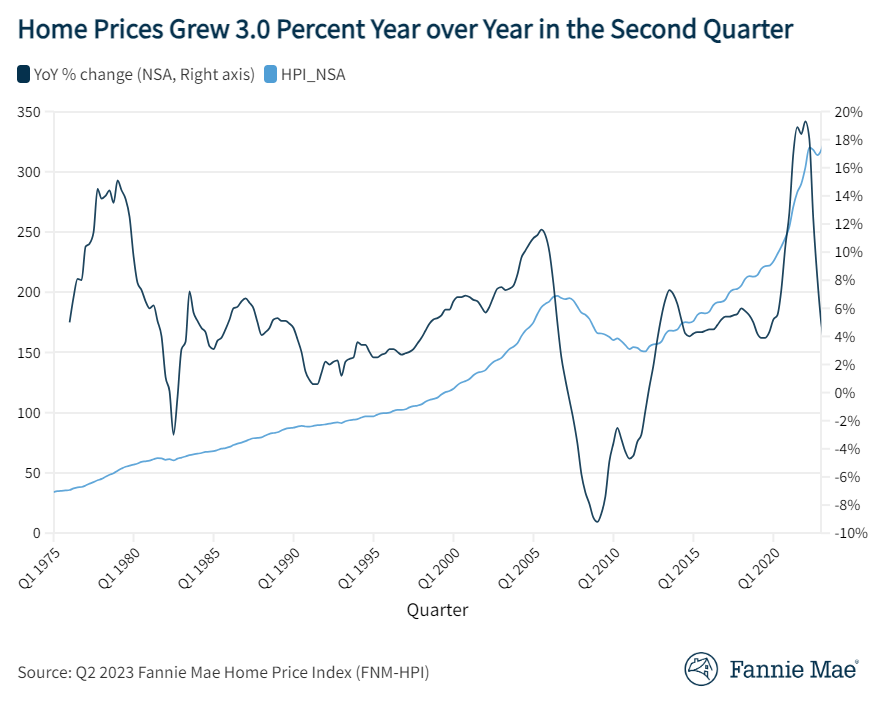

- Single-family home prices increased 3% in the second quarter of 2023 from a year earlier.

- On a quarterly basis, home prices rose a seasonally adjusted 1.9% in the second quarter.

Home prices continued to surprise in the second quarter, increasing both from the previous quarter and the same point last year, Fannie Mae said Monday.

The government-sponsored enterprise released its latest Fannie Mae Home Price Index (FNM-HPI), which measures the average quarterly price change for all U.S. single-family properties, excluding condos.

According to the index, single-family home prices increased 3% in the second quarter of 2023 from a year earlier, down from the first quarter’s revised annual growth rate of 4.9%.

On a quarterly basis, home prices rose a seasonally adjusted 1.9% in the second quarter, up from 1.3% growth in the first quarter, Fannie Mae said. On a non-seasonally adjusted basis, home prices increased by 3.6% in the second quarter.

“Once again, home-price growth surprised to the upside,” said Doug Duncan, Fannie Mae senior vice president and chief economist. “Housing demand remains resilient, which continues to butt up against the near-historically limited supply of existing homes for sale. Moreover, the ‘lock-in effect,’ in which homeowners are disincentivized to list their homes for sale because of how high mortgage rates have risen, is seriously inhibiting the supply of existing homes available for sale.”

At nearly 8% on a seasonally adjusted annualized basis, this past quarter's home price growth was well above the historical average, he said.

“With the 30-year mortgage rate once again approaching 7%, it’s yet to be seen whether mortgage demand will finally cool in response, or whether higher rates will simply further suppress supply,” Duncan said. “If the latter, we expect additional near-term home price appreciation.”

He said a consequence of the stronger home price environment “is that new home construction is well-supported. Unfortunately, any hopes of a better-balanced home supply situation may rest on the ability of homebuilders to meet ongoing demand.”

The FNM-HPI is produced by aggregating county-level data to create both seasonally and non-seasonally adjusted national indices that are representative of the whole country and designed to serve as indicators of general single-family home price trends.

The FNM-HPI is publicly available at the national level as a quarterly series with a start date of the first quarter of 1975 and extending to the most recent quarter. Fannie Mae publishes the FNM-HPI approximately mid-month during the first month of each new quarter.