Fannie Mae Implements Notice Of Potential Defect Process To Address Loan Repurchase Risks

Faced with market challenges, Fannie Mae reintroduces a Notice of Potential Defect, allowing lenders a grace period to rectify significant loan issues before repurchase requests, amid calls for broader industry reform.

In response to challenging market conditions spurred by rising mortgage rates and low origination volumes, Fannie Mae has reintroduced the Notice of Potential Defect, aiming to help lenders mitigate the economic impacts of repurchase requests and ensure financial resiliency.

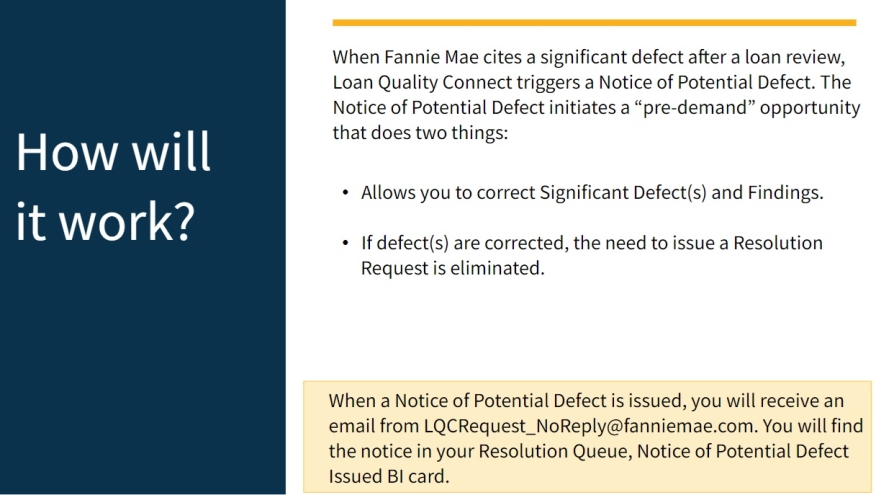

The Notice of Potential Defect, which went into effect Feb. 24, serves as an additional step in the post-purchase review process. It provides lenders with additional time to address significant defects before the issuance of a resolution request.

While it's a welcome step, Scott Olson, executive director of the Community Home Lenders of America, said it doesn't go quite far enough.

"The problem with repurchases is the same remedy that a few years ago was not as severe, became extraordinarily costly," Olson said.

He said it's not just that the loan was no longer insured, but "you were trying to sell a 3% loan in a 7% market."

Olson said the repurchase process actually manufactured losses on what were performing loans. "It forced people to be more conservative about lending to underserved borrowers," he added.

He said they would rather pay a small indemnification fee to Fannie and Freddie instead of trying to capitalize on huge losses that benefit no one.

He said that's why they were pleased when Freddie rolled out a pilot program at the end of last year that would be fee-based and largely exempt lenders from buybacks on performing loans, with charges waived for smaller lenders.

He said Fannie Mae has yet to go that far.

"Progress, but we're not there yet," Olson said.

The Federal Housing Finance Agency, responsible for supervising the two primary government-affiliated mortgage investors, has highlighted the importance of collaboration between these enterprises in this area.

Under the Notice of Potential Defect process, if Fannie Mae identifies significant defects during the full-file loan review that could render the loan ineligible and prompt a repurchase request, the Notice of Potential Defect will be issued. Lenders then have a 30-calendar-day window to correct the defects or provide additional information to resolve them.

The loans flagged with significant defects within this process will still be factored into lenders' gross defect rates, even if the defects are rectified within the 30-day window.