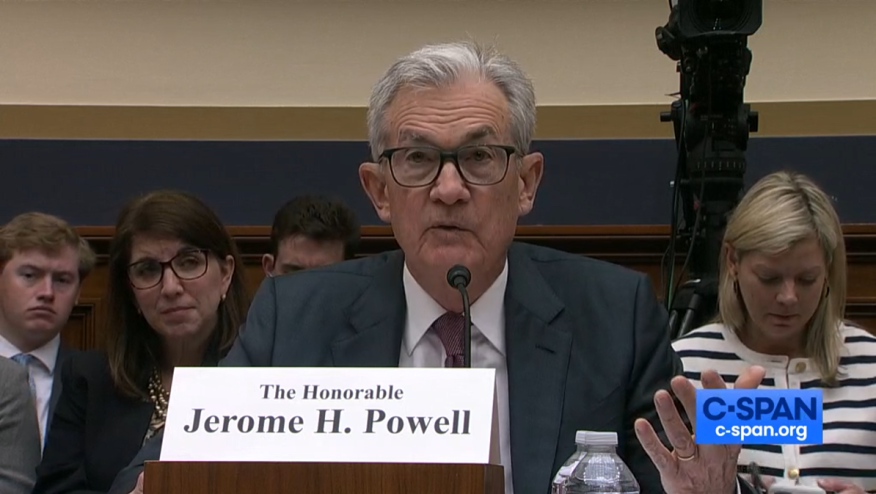

Fed Chair Tells Congress To Expect More Rate Hikes

Tells House Financial Services Committee that moderate increases still needed to curb inflation.

Federal Reserve Chairman Jerome Powell told Congress on Wednesday that interest rates will have to be increased again to curb economic growth and control inflation.

Speaking to members of the House Financial Services Committee, Powell said the increases are likely necessary even though the Fed last week paused its string of rate hikes.

The Federal Open Market Committee (FOMC) ended its two-day meeting last week by announcing it would pause its rate hikes, after raising rates 10 times in the previous 14 months.

“Earlier in the process, speed was very important,” Powell told the committee. “It is not very important now.”

He suggested that it would be prudent to continue raising rates in the upcoming months, but at a more moderate pace. The decision on timing for additional hikes will be based on incoming data, he said. The FOMC is scheduled to meet July 25-26.

While the Fed's rate hikes do not directly affect mortgage rates, the higher cost of lending for banks has pushed them to raise mortgage rates over the past year. The 30-year fixed rate is now moving in a range between 6% and 7%.

Powell's warning that higher rates are necessary to fight inflation caused U.S. stocks to fall. Analysts had speculated that the Fed’s cycle of tightening was nearing its end.

Following its June meeting, FOMC officials projected that the Fed’s benchmark rate would rise to 5.6% by the end of the year, implying two more quarter-point hikes, in order to address persistent inflation and a still robust labor market.

Powell expressed empathy for the difficulties caused by high inflation, and reiterated the Fed's commitment to bringing it down to the target goal of 2%. He said that nearly all FOMC participants expect further interest rate increases by the end of the year, noting that reducing inflation may require below-trend growth and some softening of labor market conditions.

His prepared remarks largely echoed comments he made during his post-FOMC meeting news conference last week, during which he emphasized the need to moderate the pace of rate increases following an exceptionally aggressive period and recent bank failures that could tighten credit conditions. However, he also stressed that a majority of the committee anticipates the necessity of higher rates to tame inflation.

Fed officials have been disappointed with the sluggish pace of reducing inflation. While upgrading the economic growth and labor market outlook for 2023, the FOMC now expects unemployment to rise to 4.5% next year. The rate has held between 3.4% and 3.7% since March 2022.

Powell acknowledged that the labor market is tight, despite the May increase in the unemployment rate to 3.7%. He noted signs of improving balance between labor supply and demand.

In his testimony, he referred to the Fed's semi-annual report to Congress, released last Friday, which highlighted tighter credit conditions in the U.S. following bank failures in March. He expressed concerns that these conditions could hinder economic activity, hiring, and inflation, but also admitted uncertainty regarding the extent of these effects.

Powell has faced criticism from some Democrats for the Fed’s aggressive interest-rate hikes, with Rep. Maxine Waters, D-Calif. and ranking member on the committee, warning about the potential negative impact on employment.

In addition to Wednesday’s testimony, Powell is also scheduled to appear before the Senate Banking Committee on Thursday.