Fewest Homes For Sale In May Since 2012: Redfin

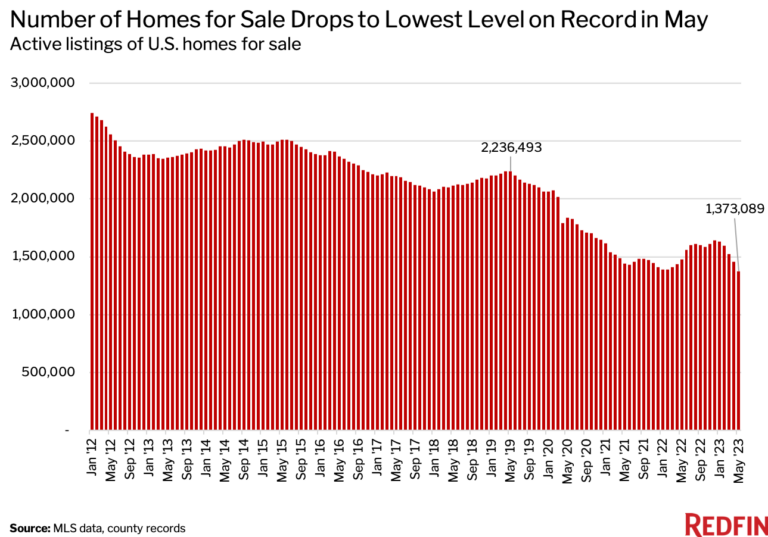

Says May's 1.4M homes for sale was the lowest ever in its records.

- The 1.4 million homes for sale was down from 2.2 million in May 2019, before the pandemic.

- New listings dropped 25.2% year over year.

Given the crisis-level lack of inventory on the U.S. housing market, you could say this was inevitable — there are fewer homes for sale than at any time in the past 11 years.

Redfin said Wednesday that the number of homes for sale in the U.S. in May fell 7.1% year over year to a seasonally adjusted 1.4 million, the lowest level in its records, which date back to 2012. It was also the first year-over-year decline in listings since April 2022.

By comparison, there were 2.2 million homes for sale in May 2019 — before the COVID-19 pandemic — meaning May’s housing supply was 38.6% below pre-pandemic levels.

New listings of homes for sale also declined, dropping 25.2% year over year in May to the third lowest level on record on a seasonally adjusted basis.

Nearly every homeowner with a mortgage is considered “locked in” — meaning they have a mortgage with an interest rate below 6% and have chosen to stay put instead of selling and buying a new home with a higher monthly mortgage payment. The 30-year-fixed mortgage rate in May averaged 6.43%, up from 5.23% a year earlier and from a record low of 2.65% in 2021.

Shortage Keeping Prices High

The median U.S. home sale price was $419,103 in May, down just 3.1% from a year earlier, when prices hit a record high of $432,311. While home prices fell in May, they posted a smaller decline than in April, when prices dropped 4.2% from a year earlier — the largest decrease on record with the exception of January 2012, Redfin said.

“It’s too early to say that price declines have bottomed out,” said Redfin Chief Economist Daryl Fairweather. “Prices may have room to fall because mortgage rates could still rise. The Federal Reserve just signaled that it is likely to continue raising interest rates this year. That could further hamper homebuyer demand and cause home prices to fall in the near term, though the drops would be minimal. We’re unlikely to see double-digit price declines like we did during the 2008 housing crisis.”

Fairweather said many people think it’s a bad time to buy a home because mortgage rates are high, “but they should keep in mind that when rates do ultimately fall, many buyers waiting on the sidelines could jump back in. That could lead to more bidding wars, since there aren’t enough homes for sale, and heightened competition could push up prices, offsetting some or all of the benefit of lower interest rates.”

The typical home that sells is no longer selling at a discount, Redfin noted. The average sale-to-list price ratio — which measures how close homes are selling to their final asking prices — was 100% in May, meaning the typical home that sold was purchased for its list price. That’s down from 103.1% a year earlier, but is the highest level of any May on record prior to the pandemic and follows nine straight months of sub-100% sale-to-list price ratios, Redfin said.

Price changes do differ vastly from market to market. For example, Austin, Texas; Boise, Idaho; and Oakland, Calif. all saw double-digit year-over-year price declines in May, while prices rose roughly 10% in Hartford, Conn.; Rochester, N.Y.; and Cincinnati.

Pandemic boomtowns and expensive coastal hubs have seen their housing markets slow relatively quickly because prices soared to unsustainable levels during the pandemic and are now coming back down to earth, Redfin said.

Watch it on The Interest: Shocking 38.6% Dip in Housing Supply

Bidding Wars

While demand from homebuyers has fallen, new listings have fallen even further, meaning many buyers are encountering bidding wars, Redfin said.

While the typical home that sold in May was purchased for its list price, more than one-third (37.5%) sold for more — a sign that some buyers are facing competition. That’s down from 59% a year earlier, but is the highest share of any May on record prior to the pandemic.

Nearly half (46.7%) of home offers written by Redfin agents faced a bidding war in May on a seasonally adjusted basis, the company said. While that’s down from 56.1% a year earlier and form a peak of 69.6% in January 2022, it’s a sign that many buyers still face competition even when demand is sluggish.

“There’s a huge lack of housing inventory in Miami, and that combined with higher interest rates is making homebuyers’ lives very challenging. Their money just isn’t going as far,” said local Redfin Premier real estate agent Rafael Corrales. “I’m encouraging my buyers to be a little more flexible; in some cases, I’m suggesting they go back to 2021 winning strategies, which can mean waiving contingencies and offering high earnest money deposits because they’re competing against a lot of cash buyers.”

Sales Falling

Closed home sales fell 19.8% year over year on a seasonally adjusted basis in May, the smallest drop in nearly a year and an improvement from the record 35.3% decline in January, Redfin said. Still, sales were significantly below pre-pandemic levels, down 21% from May 2019.

Pending home sales fell 21.4% year over year on a seasonally adjusted basis in May, the smallest drop since last summer and an improvement from the record 36.1% decline in November. Pending sales were down 16.1% from May 2019 levels, Redfin said.