Fixed Rate Mortgages Reach 13-Year High

Despite rising home prices, demand for housing units outstrips supply.

- By the end of the fourth quarter in 2021, the figure stood at $423,600 but it rose by 1.44% in the first quarter of 2022 to $429,700 — an all-time high.

- Despite rising home prices, demand for housing units outstrips supply. Consumers continue to outbid each other for homes, raising their costs.

- In the past couple of years, U.S. housing prices soared nearly 34%, with 20% of that growth occurring within the past year.

- The Federal Reserve Bank of Dallas found home prices are outpacing most American's financial ability, but they add that any market correction occurring won’t be as severe as in 2008.

A new analysis on mortgage rates from moneytransfers.com finds that steeply rising rates are either pricing homebuyers out of properties or outright disqualifying them from mortgages.

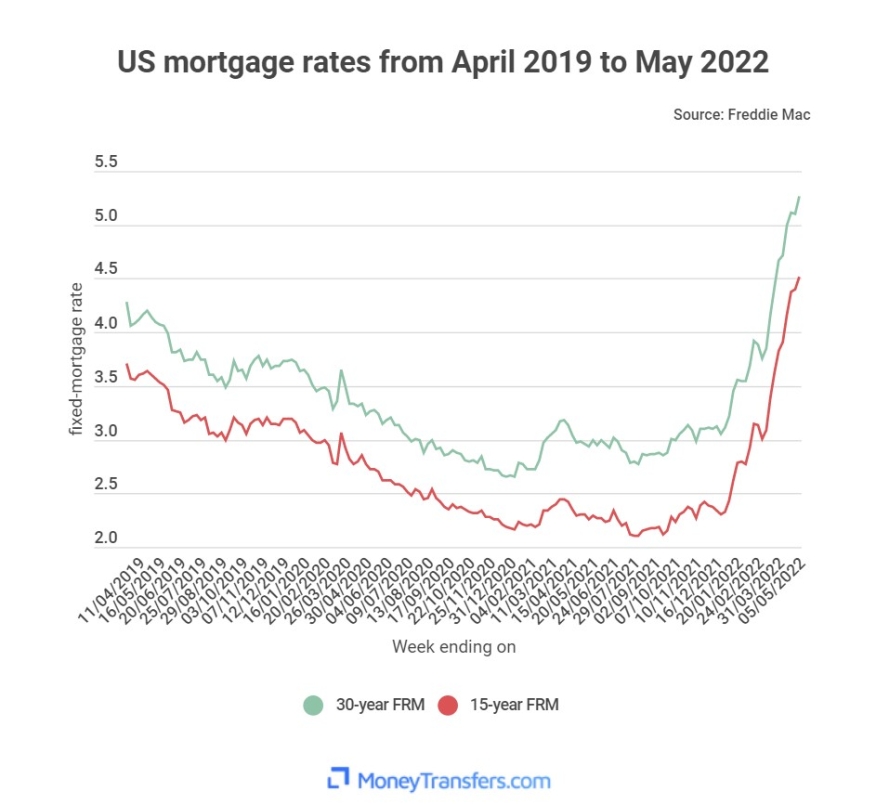

The 30-year-fixed mortgage (FRM) jumped to 5.7% on May 5, 2022, marking a 13-year high. Just last year, the FRM was 2.96%. The 15-year FRM averaged 4.52%, up from 2.3% a year ago.

“Americans are having to dig deep into their pockets for home purchases,” MoneyTransfers CEO Jonathan Merry said. “Larger monthly payments threaten to price out buyers that can’t put down significant down payments. That’s happening in the backdrop of escalating rent nationally exacerbating the difficulty of first time home ownership.”

The sharp increase in mortgage rates coincides with the rise in median house sale prices. By the end of the fourth quarter in 2021, the figure stood at $423,600 but it rose by 1.44% in the first quarter of 2022 to $429,700 — an all-time high. Within that period, the country was grappling with 11.5% inflation that severely impacted spending ability.

However, rising rates don’t appear to have dampened the enthusiasm for homeownership. Despite rising home prices, demand for housing units outstrips supply. Consumers continue to outbid each other for homes, raising their costs.

Housing prices shot through the roof at the start of the COVID-19 pandemic, with market statistics marking that upswing at 32% to 39% higher than pre-pandemic rates. The proliferation of remote work triggered the housing frenzy and a surge in need to relocate.

Prior to the pandemic, the market was in short supply of houses, partly due to the lingering impact of the Great Recession. Demand carries on, though, skyrocketing housing prices. On the bright side, the market has attracted many investors seeking to fill the void in housing supply.

In the past couple of years, U.S. housing prices soared nearly 34%, with 20% of that growth occurring within the past year. Historically, housing prices increase by 4.6% yearly.

Meanwhile, the 4.8% growth in wages in the past year hasn’t kept pace with the surge in home prices, raising concern throughout the industry. Many are speculating that the country is heading towards another housing bubble akin to 2008.

Experts from Zillow and Morty believe the country is not heading towards another housing bubble, arguing that today’s American homebuyers are better off financially than their counterparts in 2008.

A study by Bank of America supports that argument, indicating that over three-quarters of homebuyers have super-prime FICO credit scores. Back in 2008, only 25% of them did. Also mortgage debt rose to 100% of household incomes compared to the 65% it is now.

Still, the Federal Reserve Bank of Dallas conducted its research in March and found home prices are outpacing most American's financial ability, but they add that any market correction occurring won’t be as severe as the 2008 one.