Flyhomes: Nearly 80% Of Aspiring Homebuyers Slowed Or Halted Search

Lender says majority in survey cited high interest rates; offers new product to cover costs of refinancing.

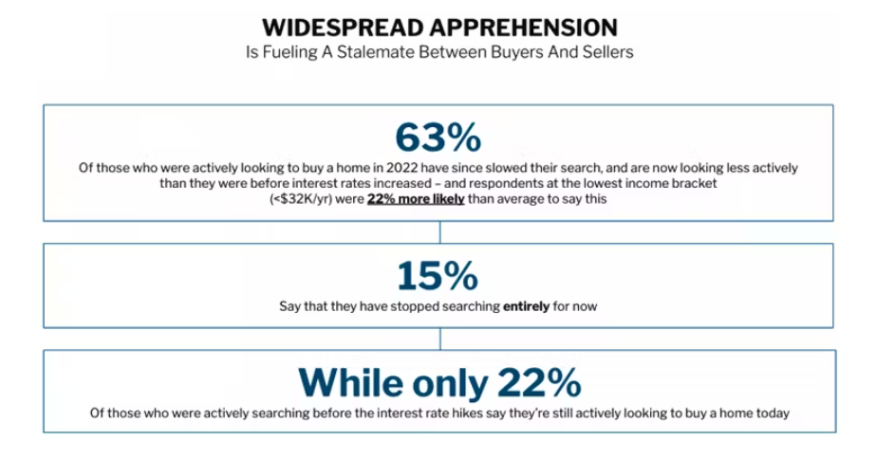

Nearly 80% of people who hoped to buy a home in the U.S. within the next three years have slowed or stopped their search for a house, according to a new survey by Flyhomes Mortgage.

The Seattle-based mortgage brokerage said its survey, conducted between Jan. 17-23, found that 78% of aspiring homebuyers had slowed or halted their search, with 86% citing high interest rates as the primary reason.

“Far too many buyers have been pushed to the sidelines because of interest rates,” said Tushar Garg, co-founder and CEO of Flyhomes.

The survey found that, of the respondents who reported slowing or stopping their home search due to interest rates, 45% agreed they were worried about being locked into a rate they can’t afford long-term. Still, 67% said they would buy a home now if given the opportunity later to refinance to a lower rate without paying closing costs.

In conjunction with releasing the survey, Flyhomes announced it will now cover the cost to refinance mortgage loans when interest rates drop, through a new product called “Buy Now Refi Later.”

With the launch, Flyhomes said, the program “becomes the first and only refinancing product on the market without lender fees, third-party costs, or timeline requirements.”

“Flyhomes was founded on the principle of ‘People, Not Properties,’ and what makes us unique is we put the client at the heart of everything we do,” Garg said. “This means that, in addition to incredible client service, we’re always analyzing the market to determine what tools our clients need to get into their dream home.”

He said Flyhomes Mortgage identified a need, “we benchmarked competitive offerings, and went beyond anything on the market today to ensure our customers can buy a house on their timeline.”

The survey found that 72% of homebuyers reported they believe rates will eventually fall, which would suggest that buying now and refinancing later would be a tempting option.

Flyhomes, however, said the survey also revealed a significant knowledge gap around refinancing, with almost half (46%) of all respondents admitting they “do not feel confident they fully understand the home refinancing process.”

According to the survey, 77% said they don’t understand what refinancing entails, and 61% said they don’t understand how to qualify.

Refinancing confidence also exists on a generational spectrum, the company said, with Baby Boomers 52% less likely than average to say they aren’t confident in what they know of the refinancing process, while Gen Z members were 35% more likely than average to say they aren’t confident.

The survey also found that 67% of all respondents said they worry that if they buy now, the cost of refinancing will be an obstacle when interest rates fall.

“The survey findings reinforce just how damaging the rise in interest rates has been on the buyer psyche and how much education and product innovation the mortgage industry needs to do,” said Dan Richards, EVP of Flyhomes Mortgage. “Learning that two-thirds of reluctant buyers would purchase now with a product that allowed them to refinance later without paying closing costs signals a major gap in the marketplace.”

With the Buy Now Refi Later product, the company said, homebuyers work with a Flyhomes loan officer to get pre-approved so they can shop for and buy a home. If rates drop in the future, Flyhomes Mortgage said, it will help clients refinance, since they will already have many of the documents on file.

In addition, the company said, it will cover the refinancing costs, waiving all lender fees and covering the majority of third-party closing costs, including appraisal, title. and government fees.

Flyhomes said Buy Now Refi Later is available to both first-time homebuyers and existing homeowners, as well as for those buying a second or vacation home.

The product is currently available only in California, Colorado, Massachusetts, Texas, and Washington, the company said.