Higher Mortgage Rates Dampening Potential Home Sales

First American says home sellers & buyers are sitting on the sidelines due to low inventory and high rates.

The potential for home sales in the current housing market declined in April from a year earlier, and is being held down because both buyers and sellers are sitting on the sidelines due to higher mortgage rates.

That’s the takeaway from the April 2023 Potential Home Sales Model report, released Wednesday by First American Financial Corp.

First American’s Potential Home Sales Model estimates what the healthy market level of home sales should be, based on economic, demographic, and housing market fundamentals.

According to the model:

- Potential existing-home sales increased to a 5.34 million seasonally adjusted annualized rate (SAAR), up 0.45% from March.

- The rate represents a 53.3% increase from the market potential low point, which was reached in February 1993.

- The market potential for existing-home sales, however, decreased 7.7% from a year earlier, a loss of 443,350 (SAAR) sales.

- Currently, potential existing-home sales is 1.45 million (SAAR), or 21.3% below the pre-recession peak of market potential, which occurred in April 2006.

While the figures for actual sales of existing homes in April has not yet been released, the National Association of Realtors reported that sales in March totaled a seasonally adjusted annual rate of 4.44 million, down 2.4% from February.

First American Chief Economist Mark Fleming says the housing market is sluggish, and he says the reason is buyers and sellers are playing a waiting game.

“The housing market remains sluggish heading into the spring home-buying season,” Fl;eming said. “While mortgage rates have retreated from recent peaks, they remain elevated compared with one year ago. Higher mortgage rates have a dual impact on sales — pricing out buyers who lose purchasing power, and keeping some potential sellers rate-locked in. There are plenty of potential buyers sitting on the sidelines, but they are likely waiting for housing supply and affordability to improve before entering the market.”

The primary factor holding back housing market potential, though, “was existing homeowners staying put,” he said.

Fleming noted that tenure length — the number of years a homeowner lives in their home — hit a historic high in April of 10.7 years, and he cited two reasons for sellers remaining on the sidelines.

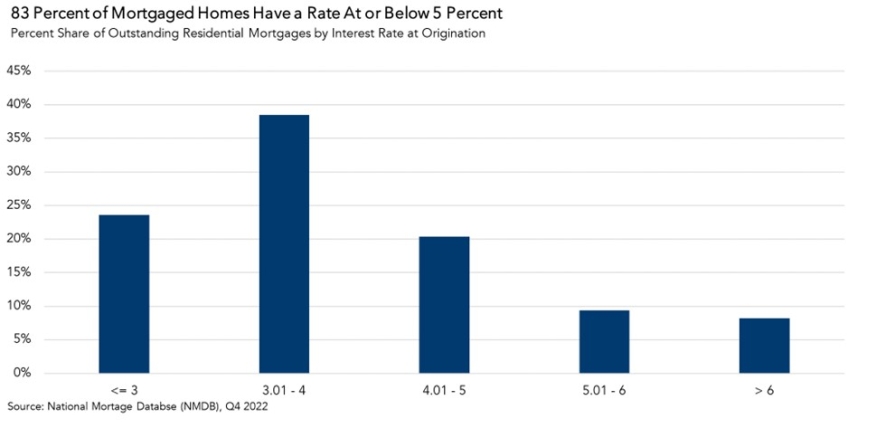

- The Golden Handcuffs: Existing homeowners are hesitant to sell because mortgage rates are above 6%. “Eighty-three percent of existing homeowners have mortgages with rates below 5%,” he said. “Why would anyone sell their home when it will cost significantly more each month to borrow the same amount from the bank?”

- When Your Home Becomes Your Prison: “The housing market is unlike most markets,” Fleming said. “Typically, the seller, or supplier, makes their decision to add supply to the market independent of the buyer, or source of demand, and their decision to buy. Yet, in the housing market, the seller and the buyer are in many cases the same – the existing homeowner. To buy a new home, you must sell the home you already own, and then find a home to buy. But not just any home — one that you like better. … The fewer homes there are for sale, the harder it becomes to find something better than what you already have.”

That creates a “prisoner’s dilemma,” he said, a situation in which individuals don’t cooperate with each other, even though it may be in their best interest to do so.

“If potential sellers all choose to sell, they would all benefit as buyers because they would increase the inventory of homes available and alleviate the supply shortage,” Fleming said. “However, the risk of selling if others don’t in a market with a shortage of inventory prevents many existing homeowners from selling altogether.”

Still, he acknowledges that the decision to buy and sell a home is more than just a financial one.

“An existing homeowner may choose to sell for lifestyle reasons, even if it means losing their low mortgage rate,” Fleming said. “Additionally, 42% of homeowners own their home free-and-clear, so they are not deterred by higher mortgage rates. Even with these mitigating factors, it will be difficult for existing-home sales to meaningfully increase while homeowners remain chained to their homes by their golden handcuffs and confounded by the prisoner’s dilemma of whether to sell or not.”