Home Delistings Hit Record High In November

Redfin says pandemic boomtowns, especially on the West Coast, saw significant increases in delistings.

- Sacramento, Austin, and Phoenix saw the biggest jump in delistings, as high housing costs dampened buyer demand.

- California saw the highest overall share of delistings, with Sacramento posting the biggest year-over-year jump.

Sellers pulled their homes off the market at a record rate last month, either because they received no offers for the list price, or received no offers at all.

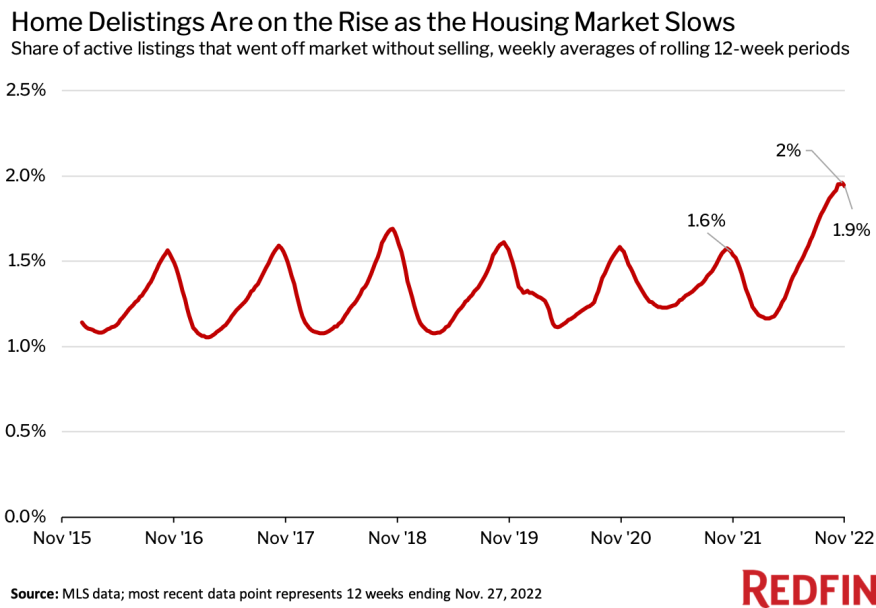

That's according to a a new report from Redfin, which found that a record 2% of U.S. homes for sale were delisted each week on average during the 12 weeks ended Nov. 20, compared with 1.6% a year earlier.

That share has since slipped back, dipping to 1.9% during the 12 weeks ended Nov. 27, which included the Thanksgiving holiday, Redfin said.

Redfin attributes the high number of delistings to a sharp drop in homebuyer demand driven by rising mortgage rates and persistently high home prices.

Even though mortgage rates have started to cool slightly since mid-November, the monthly mortgage payment on the median-asking-price home is still 40% higher than a year ago.

“Some sellers are having a hard time grasping that we’re not in a housing-market frenzy anymore — it’s tough for them to swallow that they missed the boat on getting a high price,” said Heather Kruayai, a Redfin real estate agent in Jacksonville, Fla. “By the time sellers realize their listing was priced too high, it has already been on the market for too long and is considered stale. I recently had two sellers take their homes off the market after 45-plus days.”

Boomtowns See Listings Drop

The report shows that pandemic boomtowns like Sacramento, Calif.; Austin, Texas; and Phoenix saw the biggest jump in delistings, as high housing costs dampened buyer demand. In Austin, the median home-sale price was up a record 43.5% year over year in the spring of 2021, but growth had shrunk to just 3.7% as of October 2022. As for Sacramento, there was 0% annual home-price growth in October, compared with as much as 29.3% last spring.

Also in Sacramento, 3.6% of active listings were delisted per week on average during the 12 weeks ended Nov. 27, up 1.6 percentage points from one year earlier — the largest increase among the metros Redfin analyzed. Austin had an increase of 1.5 percentage points, while Seattle jumped 1.4 points, and Phoenix followed shortly behind at 1.3 points.

California saw the highest overall share in delistings, as the expensive West Coast market begins to slow. Sacramento not only saw the biggest year-over-year jump in delistings, it also had the highest overall share, with 3.6% of for-sale homes delisted per week on average during the 12 weeks ended Nov. 27. It was followed by San Francisco with 3.4% being delisted and Oakland with 3.3%.