Home Flippers Flip The Script In Q1

Flips increased to 9% of sales as profit margins post modest increase.

- In Q1, 9% of all single-family homes and condos sold were flipped, up from 8% in Q4 2022.

- Typical profit margin from flipping was 22% in Q1.

- Gross profit increased to $56,000, but was still down from $70,000 a year earlier.

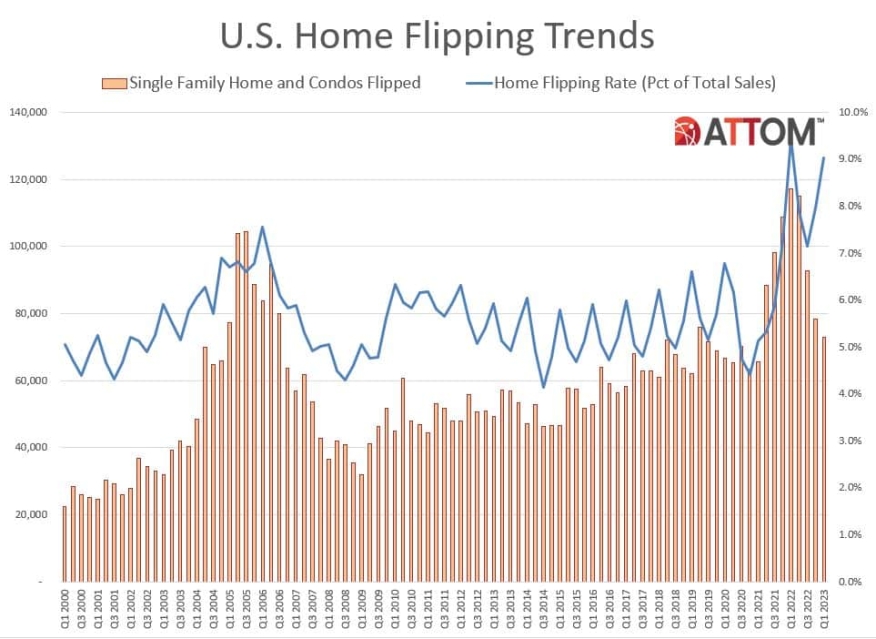

In the first quarter of 2023, 9% of all single-family homes and condominiums sold were flipped, up from 8% in the previous quarter, ATTOM said Thursday.

The land, property, and real estate data company released its first-quarter 2023 U.S. Home Flipping Report, which showed that 72,960 single-family homes and condos were flipped during the quarter.

A single-family home or condo is considered flipped if two sales transactions involving the same property occurred within the past 12 months.

While the number of flips increased from the fourth quarter, the latest result was down from 9.4% of all home sales in the first quarter of 2022. The 9% of homes flipped in the first-quarter of this year, however, was the second-highest level this century, ATTOM said.

Mixed Trends For Profits

While flipping activity rose, the report found mixed trends for raw profits and profit margins. Profits and investment returns both increased slightly from the fourth quarter of 2022, but both also remained near low points over the past decade, reflecting ongoing financial struggles for home flippers, ATTOM said.

The quarterly increase in the typical profit margin, of 22%, represented a modest reversal for investors following three years of nearly continuous declines that began well before a slowdown in the broader U.S. housing market last year, the company said.

"Home-flipping investors across the U.S. may have finally halted the decline," said ATTOM CEO Rob Barber. "In the first quarter, profit margins showed a slight upward turn after an extended slump, while interest in flipped homes continued to rise among buyers.”

Barber noted, however, that investors shouldn't assume they're out of the woods in terms of profit. “Home-flipping carrying costs can easily erase a 22% return on gross profits, and it's possible that the recent gain is merely a temporary blip,” he said. “Nevertheless, the first-quarter trends offer some hope for investors indicating that brighter times may lie ahead."

Among flips nationwide, the gross profit on typical transactions — the difference between the median purchase price paid by investors and the median resale price — increased to $56,000 in the first quarter of this year. That remained down 20% from $70,000 in the first quarter of 2022, and remained at one of the lowest points since the U.S. housing market began recovering in 2012 from the Great Recession that struck in the late 2000s.

Nevertheless, ATTOM said, the total profit of typical flips nationwide was up 4.7% from $53,500 in the fourth quarter of 2022.

Typical profit margins, meanwhile, also ticked up during the first three months of this year, after falling in eight of the prior nine quarters.

The typical gross flipping profit of $56,000 in the first quarter translated to a 22.5% return on investment compared to the original acquisition price. While the typical margin remained down from 26.9% in the first quarter a year earlier — and was still less than half of the 51.5% level recorded in the middle of 2020 — it inched up from 21.7% in the fourth quarter of last year.

Profits and profit margins turned around a bit in the first quarter becuase median resale prices on flipped homes rose slightly faster than they did when investors were buying homes.

Specifically, in the first quarter of 2023 the typical resale price on flipped homes increased 1.7%, from $300,000 in the fourth quarter of 2022 to $305,000 in the first quarter of this year. That was better than the 1% increase in the median price that recent home flippers commonly saw when they bought their properties.

The recent profit turnaround, though modest, continued an unusual pattern of home-flipping fortunes that run counter to the broader U.S. housing market. For the prior three years, investment returns mostly dropped. That was happening despite prices and profits for traditional sellers soaring during an extended, decade-long boom period for the overall market, ATTOM said.

Investor woes continued last year as the housing market surge stalled amid rising mortgage rates, high consumer price inflation, a faltering stock market, and economic uncertainty.

Other Highlights

- Home flips as a portion of all home sales increased from the fourth quarter of 2022 to the first quarter of 2023 in 128 of the 172 metropolitan statistical areas around the U.S. with enough data to analyze (74%). The increases were mostly less than 2 percentage points. (Metro areas were included if they had a population of 200,000 or more and at least 50 home flips in the first quarter of 2023).

- Among those metros, the largest flipping rates during the first quarter of 2023 were in Macon, Ga. (flips comprised 16.8% of all home sales); Atlanta (15.3%); Jacksonville, Fla. (15.2%); and Memphis (14.4%) and Clarksville, Tenn. (14.3%).

- The smallest home-flipping rates among metro areas analyzed in the first quarter were in Indianapolis, Ind. (4%); Wichita, Kan. (5%); Bridgeport, Conn. (5%); Madison, Wisc. (5.2%) and South Bend, Ind. (5.3%).

- Profit margins went up quarterly in 103 of the 172 metro areas analyzed (60%), though they were still below levels from the first quarter of 2022 in 132, or 77%, of those markets.

- Despite the quarterly gains, typical flipping profits remained less than 30% in 81 of the 172 metros with enough data to analyze in the first quarter of 2023 (47%). That was slightly better than the level in the fourth quarter of last year, but still was worse than the level of a year earlier, when profit margins on median-priced home flips fell below 30% in just a third of those metro areas.

- The highest raw profits on median-priced home flips in the first quarter of 2023, measured in dollars, remained concentrated in the South and Northeast; 18 of the top 20 were in those regions, led by Bridgeport (typical gross profit of $171,000); Boston ($157,000); New York ($144,374); San Jose, Calif. ($140,000); and Worcester, Mass. ($135,000).

- Nationwide, 66.1% of homes flipped in the first quarter of 2023 had been purchased by investors using all cash. That was virtually unchanged from the 66% level in the fourth quarter of 2022 and the 65.7% portion in the first quarter of 2022.

- Meanwhile, 33.9% of homes flipped in the first quarter of 2023 had been bought with financing, about the same as in the prior quarter (34%) and a year earlier (34.3%).

- The average time it took from purchase to resale on home flips rose to 178 days in the first quarter of 2023, up from 165 in the fourth quarter of 2022 and 163 days in the first quarter of 2022.

- Of the 72,960 U.S. homes flipped in the first quarter, 11% were sold to buyers using loans backed by the Federal Housing Administration (FHA), marking the third straight quarterly gain. That was up from 9.8% in the prior quarter and 7.8% a year earlier.