Home Price Growth Cools; Starter Homes An Exception

First American's March HPI makes monthly gain of 0.9%

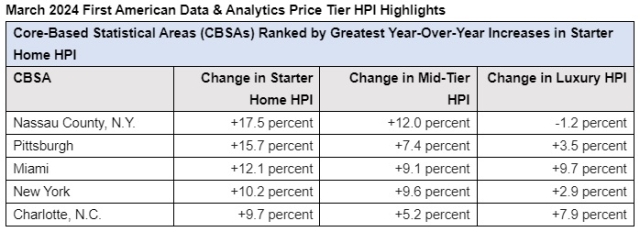

Home price growth is likely to continue its cooling trend as high mortgage rates show no signs of relenting anytime soon. An exception is starter homes, which grew in price as much as 17.5% year-over-year in March.

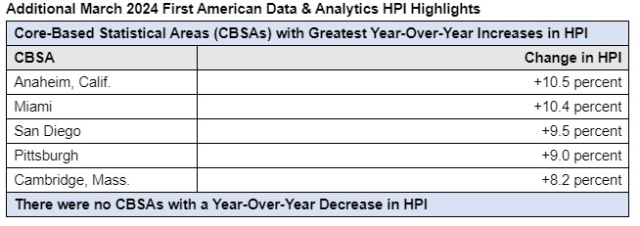

First American Data & Analytics’ March 2024 Home Price Index (HPI) report showed 0.9% growth between February and March 2024 and 6.2% growth year over year. The slight month-over-month increase mirrors the average monthly gain during the eight years preceding the pandemic. It follows what analysts referred to as “a three-year rollercoaster ride” during which home prices interchanged with mortgage rates in spikes and falls before finally relenting in February.

“Persistent inflation has diminished any optimism that the Federal Reserve may start to cut rates in June, meaning mortgage rates seem more and more likely to remain ‘higher for longer’ this year,” said Mark Fleming, chief economist at First American. “Many sellers will remain on strike keeping a lid on supply. However, as we saw last fall when mortgage rates peaked, demand may also wane. Even though the supply of homes for sale will remain tight, sagging demand should further slow price appreciation in a ‘higher-for-longer’ mortgage rate environment.”

In this ‘higher-for-longer’ market scenario, starter homes may appreciate more, simply due to the fact that they are in higher demand.

“Starter homes are the least supplied because it is the market segment most supplied by existing homeowners, who are the most vulnerable to the rate lock-in effect and thus unable or unwilling to list their home for sale to fuel a move-up purchase,” Fleming explained. “Starter-tier prices are increasing year over year by more than 10% in Nassau County, N.Y., Pittsburgh, Miami and New York.”

Home prices nationally are now 52% higher than they were at the start of the pandemic, in February 2020.

Price growth from January to February 2024 was revised in March’s HPI up 0.3 percentage points, from 0.7% to 1%.