House Prices Up At Least 18.2% YOY In January 2022

FHFA numbers come in slightly lower than S&P CoreLogic Case-Shiller index.

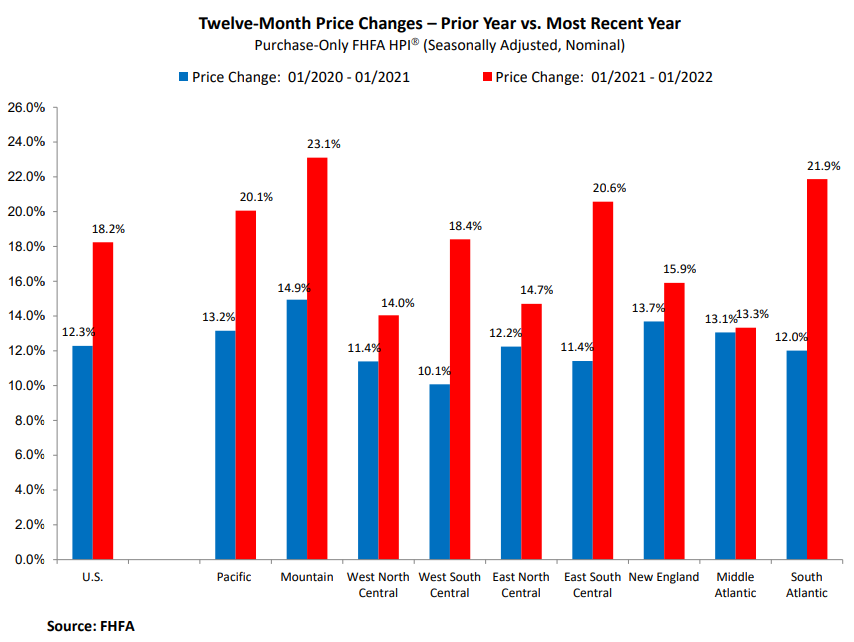

The rise in house prices continues apace nationwide based on two reports released this morning. January 2022 housing prices increased 1.6% from December 2021. Year over year, they jumped at least 18.2%.

Those numbers are according to the latest Federal Housing Finance Agency (FHFA) House Price Index. However, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.2% annual gain in January, up from 18.9% in the previous month.

The difference in numbers comes from how the data is collected. The FHFA HPI uses nominal, seasonally adjusted, purchase-only data from Fannie Mae and Freddie Mac. The S&P CoreLogic Case-Shiller U.S. National Home Price Index tracks the value of single-family housing within the United States.

“House price trends notched up slightly in January,” said Will Doerner, Ph.D., supervisory economist in FHFA’s Division of Research and Statistics. “Rising mortgage rates in January certainly reflect a major change from the past several years, but lending costs remain relatively low. The mortgage rate shift has not dampened upward price pressure from intense borrower demand and limited supply.”

According to the FHFA, for the nine census divisions, seasonally adjusted monthly house price changes from December 2021 to January 2022 ranged from +0.1% in the New England division to +2.2% in the South Atlantic division. The 12-month changes ranged from +13.3% in the Middle Atlantic division to +23.1% in the Mountain division.

“Home-price changes in January 2022 continued the strength we had observed for much of the prior year,” said Craig J. Lazzara, managing director at S&P DJI. “The National Composite Index recorded a gain of 19.2% for the 12 months ended in January 2022; the 10- and 20-City Composites rose 17.5% and 19.1%, respectively. All three composites reflect a small acceleration of price growth for January 2022.

“Last fall we observed that home prices, although continuing to rise quite sharply, had begun to decelerate," Lazzara said. "Even that modest deceleration was on pause in January. The 19.2% year-over-year change for January was the fourth-largest reading in 35 years of history.”

In another report released today, First American Financial Corp. released its Real House Price Index, noting that while prices are now higher, house-buying power remains almost 30% below the April 2006 peak.