Household Debt Climbs As Mortgage Originations Fall

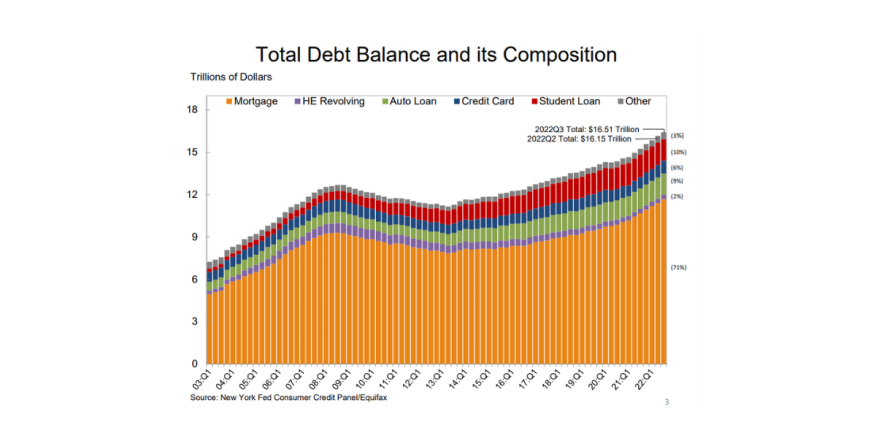

Total household debt in the quarter increased 2.2% to $16.51 trillion.

- Mortgage originations saw a $126 billion decline from the second quarter.

- Balances now stand $2.36 trillion higher than at the end of 2019.

- Mortgage balances rose by $282 billion in the third quarter of 2022 and stood at $11.67 trillion at the end of September.

U.S. households were $351 billion more in debt in the third quarter, even as new mortgage purchase and refinance loans declined.

Total household debt in the quarter increased by $351 billion, or 2.2%, to $16.51 trillion, according to the quarterly report on household debt and credit released Wednesday by the Federal Reserve Bank of New York's Center for Microeconomic Data.

Balances now stand $2.36 trillion higher than at the end of 2019, before the pandemic recession. The report is based on data from the New York Fed's nationally representative Consumer Credit Panel.

Mortgage originations, which include refinances, stood at $633 billion in the third quarter, a $126 billion, or 16.6%, decline from the second quarter and a return to pre-pandemic volumes, the report said.

The volume of newly originated auto loans was $185 billion, a slight reduction from the previous quarter but still elevated compared to the average volumes seen through the 2018-19 period. Aggregate limits on credit card accounts increased by $82 billion and now stand at $4.3 trillion.

Mortgage balances rose by $282 billion in the third quarter of 2022 and stood at $11.67 trillion at the end of September, representing a $1 trillion increase from the previous year.

Other third-quarter increases included credit card balances and auto loan balances, which jumped by $38 billion and $22 billion, respectively.

"Credit card, mortgage, and auto loan balances continued to increase in the third quarter of 2022, reflecting a combination of robust consumer demand and higher prices," said Donghoon Lee, economic research advisor at the New York Fed. "However, new mortgage originations have slowed to pre-pandemic levels amid rising interest rates."

The share of current debt becoming delinquent increased for nearly all debt types, following two years of historically low delinquency transitions. The delinquency transition rate for credit cards and auto loans increased by about half a percentage point, similar to increases seen in the second quarter.