loanDepot Reports 4th Consecutive Quarterly Loss

Vision 2025 plan helped reduce loss to $91.7m; expense reductions included cutting 52% of staff.

- loanDepot reported a net loss of $91.7 million, or 25 cents per diluted share, down 42% from Q4 2022.

- Revenue grew 22.5% to $207.9m, but was down 59% from Q1 2022.

- Over the past year, loanDepot has cut 5,200 jobs.

Another quarter, another loss for loanDepot.

The nation’s third-largest mortgage lender by funded loan volume posted its 2023 first-quarter results after the markets closed Tuesday, reporting its fourth-consecutive quarterly loss.

loanDepot reported a net loss of $91.7 million, or 25 cents per diluted share, down 42% from a net loss of $157.8 million, or 46 cents per diluted share, in the fourth quarter of last year. The loss was close to the loss of $91.3 million it reported a year earlier.

The improvement came as revenue grew. For the first quarter, total revenue was $207.9 million, up 22.5% from $169.7 million in the previous quarter, but down nearly 59% from $503.3 million a year earlier.

While the earnings per share was worse than the loss of 23 cents per share analysts expected, total revenue beat the consensus estimate of $174.2 million, according to Seeking Alpha.

In addition to the higher revenue, company officials said the reduction in the quarterly loss was driven by continued expense reductions under its Vision 2025 strategic plan. That plan, announced in July 2022, includes four “pillars”:

- Transforming loanDepot’s originations business do drive purchase money transactions with expanded emphasis on first-time home-buyers and serving diverse communities;

- Aggressively “right-sizing” the company’s cost structure in line with current and anticipated market conditions and to achieve internal operating performance targets;

- Selectively investing in “profitable growth-generating initiatives; and

- Optimizing the company’s organizational structure.

“When we announced Vision 2025, we established the goal of reducing our expenses by an annualized amount of $375 million to $400 million,” CEO Frank Martell said during a webcast with analysts. “Today, I can confirm that our team has overachieved against our Vision 2025 expense reduction goal,” with non-volume-related expenses “down $130 million since the second quarter of 2022, or over $500 million annualized.”

That reduction in expenses included slashing the company’s workforce by more than half. According to the report, loanDepot reduced its staff from 10,000 at the end of the first quarter of 2022 to 4,800 people by the end of the first quarter of this year – a reduction of 5,200 people, or 52% of its workforce.

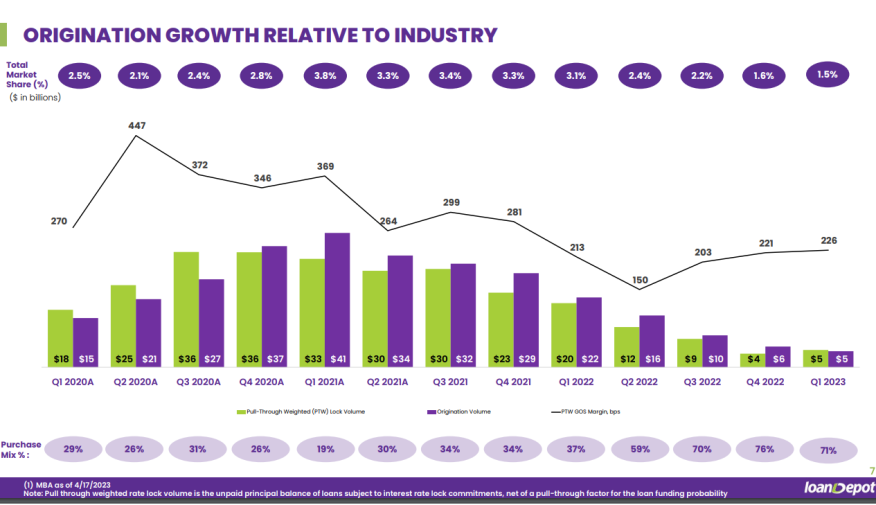

Loan origination volume also has fallen. According to the report, loanDepot originated $4.9 billion in loans in the first quarter, down 22.5% from $6.38 billion in the fourth quarter and down 77% from $21.6 billion a year earlier.

Purchase volume decreased to 71% of total loans during the quarter, down from 76% of total loans during the fourth quarter of last year but up from 37% of total loans during the first quarter of 2022, the company said.

Its servicing portfolio increased just slightly during the quarter, with total unpaid principal balance (UPB) of $141.7 billion at the end of the quarter, compared to $141.2 billion at the end of the fourth quarter of last year.

loanDepot did report strong liquidity, with nearly $800 million in unrestricted cash and equivalents, and an undrawn borrowing capacity of $4 million at the end of the first quarter.

Asked whether his company can end the string of losses over the next year despite the continuing challenges posed by the housing market, Martell was optimistic.

“Getting to a run-rate profitability continues to be a North Star under the Vision 2025,” Martell said. “It’s just a function of the market and managing through the market, and it’s certainly the roughtest market in a generation, for sure. But I think we have liquidity, and we have a very sound and prudent capital management strategy that will see us through this cycle.”