loanDepot Reports Its 5th Quarterly Loss

Focuses on growth, cost structure alignment, and support for first-time homebuyers.

California-based LoanDepot Inc. (LDI), which has had its fair share of legal battles, leadership changes, and consolidations over the past year, reported a net loss Tuesday of $49.8 million in the second quarter. Year over year it's a significant improvement. For the second quarter of 2022, loanDepot posted a net loss of $223.8 million.

The nation’s third-largest mortgage lender by funded loan volume said the decrease in the loss quarter over quarter is primarily due to an increase in revenues and operating efficiency benefits. In the first quarter its loss was $91.7 million.

In April, loanDepot resolved internal discord between its founder and chairman, Anthony Hsieh, and the board of directors. Several months later, the firm announced the departure of four senior executives.

The organizational shifts were accompanied by a decision to merge LDI Digital, which includes mellohome, into its existing production channels, with the oversight now handled by LDI Mortgage President Jeff Walsh.

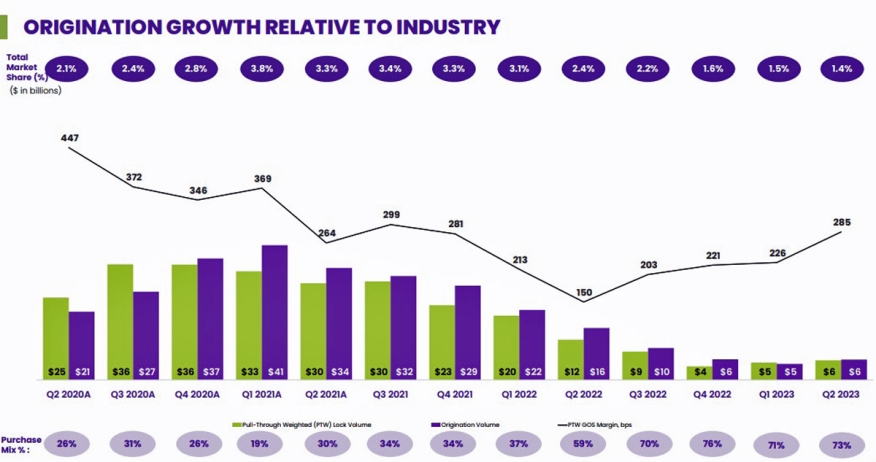

The company’s total revenues saw a significant increase in the second quarter, reaching $271.8 million, up from $207.9 million in the prior quarter. This surge was “mainly attributed to a higher pull-through weighted lock volume and an increase in the gain on sale margin,” according to a statement provided to investors.

“loanDepot continues to make significant progress against the strategic imperatives laid out in our Vision 2025 plan,” President and CEO Frank Martell said. “We delivered our second successive quarter of strong top line growth and margin expansion on a sequential basis, and at the same time, continued to drive cost productivity and operating leverage. Importantly, we reduced our sequential quarterly net loss by $66 million in the first quarter of 2023 and by $42 million in the second quarter.”

Martell said they continue to work on resetting the cost structure while remaining focused on their Vision 2025 plan.

That plan, announced in July 2022, includes four “pillars”:

- Transforming loanDepot’s originations business do drive purchase money transactions with expanded emphasis on first-time home-buyers and serving diverse communities;

- Aggressively “right-sizing” the company’s cost structure in line with current and anticipated market conditions and to achieve internal operating performance targets;

- Selectively investing in “profitable growth-generating initiatives; and

- Optimizing the company’s organizational structure.

The company reduced its headcount to 4,683 from 8,540 at the end of the second quarter 2022, but legal fees have been holding the company back. It accrued $7.5 million of legal expenses related to the settlement of outstanding litigation.

Martell said higher origination volumes cost the company $16 million in the second quarter and if the legal fees were excluded due to their non-recurring nature it would result in a 4% reduction in the core operating expenses.

Pull through weighted lock volume of $6.1 billion for the three months ending June 30, 2023, an increase of $0.7 billion or 14% from the first quarter of 2023, resulting in quarterly total revenue of $271.8 million, an increase of $63.9 million, or 31%, over the same period.

Loan origination volume for the second quarter of 2023 was $6.3 billion, an increase of $1.3 billion or 27% from the first quarter of 2023.

Martell said they are “deepening their support for first-time homebuyers,” and are looking to improve minority homeownership.

Purchase volume increased to 73% of total loans originated during the second quarter, up from 71% of total loans originated during the first quarter of 2023 and up from 59% of total loans originated during the second quarter of 2022.

For the three months ending June 30, 2023, its preliminary organic refinance consumer direct recapture rate increased to 69% from the first quarter’s refinance rate of 67%.

“This highlights the efficacy of our marketing efforts, the strength of our customer relationships, and the value of our servicing portfolio for adjacent and complementary revenue opportunities,” the company said in a press release.

The servicing side remained fairly consistent earning around $118 million this quarter, down slightly from $119 million in the first quarter.