Lumber Turns Cheaper, Builder Confidence Scales Optimistic Heights

As the supply-demand seesaw finally begins to balance, builder sentiment peaks, marking the end of a year-long housing drought.

The housing market, battling a supply drought for nearly a year, has created a resurgence in builder sentiment into optimistic territory for the first time since July 2022.

The National Association of Homebuilders (NAHB) attributes the robust demand to a scarcity of pre-existing inventory and enhanced supply chain proficiency.

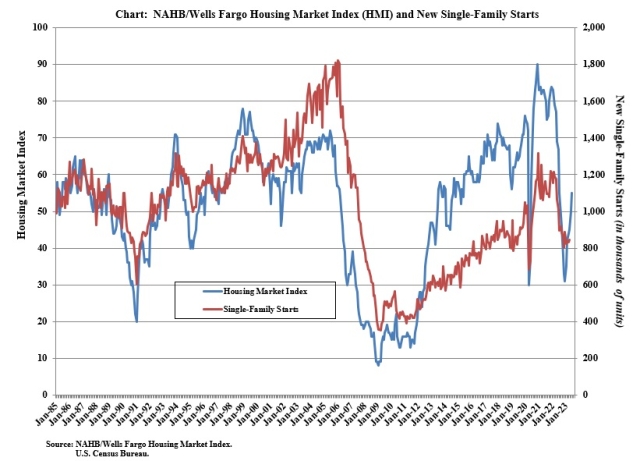

The NAHB/ Wells Fargo Housing Market Index (HMI) recorded a five-point rise in builder confidence to a score of 55 for June, marking the sixth straight month that builder confidence has increased and the first time it surpassed the midpoint of 50 back in July 2022.

“Builders are feeling cautiously optimistic about market conditions given low levels of existing home inventory and ongoing gradual improvements for supply chains,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “However, access for builder and developer loans has become more difficult to obtain over the last year, which will ultimately result in lower lot supplies as the industry tries to expand off cycle lows.”

NAHB Chief Economist Robert Dietz said, “This month marks the first time in a year that both the current and future sales components of the HMI have exceeded 60, as some buyers adjust to a new normal in terms of interest rates. The Federal Reserve nearing the end of its tightening cycle is also good news for future market conditions in terms of mortgage rates and the cost of financing for builder and developer loans.”

Watch it on The Interest: Builder Sentiment Optimistic

While the Federal Reserve’s Open Market Committee decided last week not to increase interest rates, Dietz pointed out that shelter costs are now driving inflation.

“Shelter cost growth is now the leading source of inflation, and such costs can only be tamed by building more affordable, attainable housing – for-sale, for-rent, multifamily and single-family,” he said. “By addressing supply chain issues, the skilled labor shortage, and reducing or eliminating inefficient regulatory policies such as exclusionary zoning, policymakers can play an important and much-needed role in the fight against inflation.”

The NAHB said another sign of gradual optimism for the state of demand for single-family homes, the June HMI survey shows that overall, builders are gradually pulling back on sales incentives:

- 25% of builders reduced home prices to bolster sales in June. The share was 27% in May and 30% in April. It has declined steadily since peaking at 36% in November 2022.

- The average price reduction was 7% in June, below the 8% rate in December 2022.

- 56% of builders offered incentives to buyers in June, slightly more than in May (54%), but fewer than in December 2022 (62%).

Corelogic reported Monday that costs for lumber and plywood have decreased significantly this year. The cost for rebar, steel studs, and PVC pipes have also decreased, but the cost of carpet, door slabs, clay bricks, insulation, and concrete have increased.

“A bottom is forming for single-family home building as builder sentiment continues to gradually rise from the beginning of the year,” Dietz said.

The NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three major HMI indices posted gains in June.